A Simple Guide to Understanding and Using Indiana Forest Products Prices

For over six decades, delivered log prices in Indiana have been collected and reported on an annual basis, previously by the Department of Forestry and Natural Resources of Purdue University (FNR) and currently by the Indiana Division of Forestry (INDoF). An interactive online tool (publicly available at foresteconomics.info), recently developed by FNR, visualizes these prices in nominal and real terms, as well as provides custom functions for better comprehending the price trends (Figure 1). Nominal prices reflect values of logs at the time they were delivered to mills while real prices are adjusted for inflation thus represent the true values of logs. Inflation over time is represented by the Consumer Price Index (CPI), published by the Bureau of Labor Statistics (www.bls.gov). To compare changes in prices at different points in time, especially when they are far apart, one is advised to compare them in real terms.

Utilizing this rich and valuable information will help landowners make informed decisions in forest management and timber sales. In order to do that, it is important to understand the relationship between three different prices: stumpage, delivered log, and lumber. Stumpage price is the price paid for standing trees, offered by timber buyers to landowners. Delivered log price, as its name suggests, is the price paid for logs delivered to mills. Lumber price is what mills receive for Green lumber. In general, both stumpage and delivered log prices are derived from lumber prices, also affected by numerous factors including economy, consumers’ preferences, fuel price, site accessibility, topography, species make-up, weather, season, etc. (Figure 2). In particular, stumpage price is greatly influenced by accessibility, local and regional reputation of timber quality, species composition, and if the owner has a competitive sale process in some cases. Moreover, stumpage price is largely impacted by competition in related markets. For example, the stave market is driving the prices of white oak stumpage and log high right now and consequently affects sawlog and veneer markets and pricing. Hardwood veneer markets are very specialized and driven by the expected aesthetic qualities of the wood for decorative applications, thus prices can be volatile and difficult to predict.

The readily available delivered log prices make it possible to estimate the stumpage value for trees of specific species, sizes, and grades. The general formula to use is:

Stumpage price = Delivered log price – per-unit logging & hauling costs – profit margin

The statewide average of combined logging and hauling costs are currently estimated at 0.225 – 0.275 per board feet (IDNR 2018), respectively, but it is important to keep in mind that both costs are dependent on fuel price and change with season, weather, distance to mills, and site accessibility and condition. In addition, the logging cost is highly variable and the rule of thumb is the more challenging the harvesting condition, the higher the cost. For example, steep ground slows down logging, so costs per unit harvested increase. The profit margin of loggers is usually rather low.

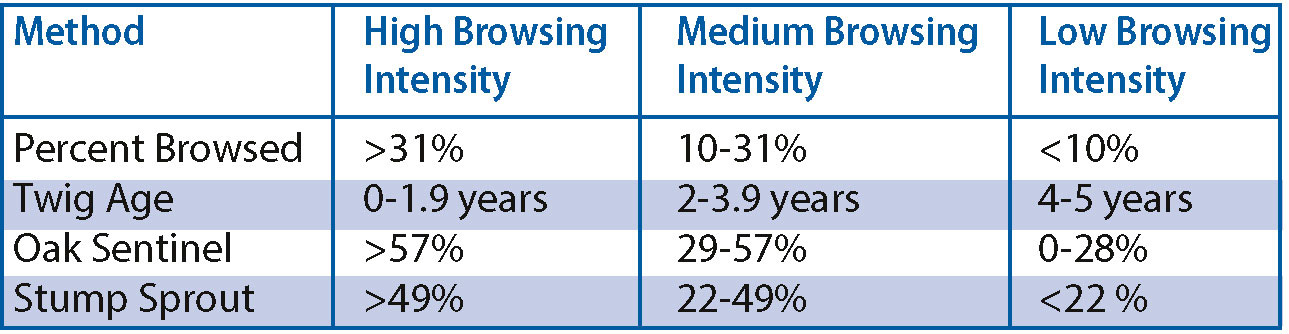

Tree quality and size are two other critical factors in determining the stumpage value. Forest Service provides standards for grading hardwood trees and logs (Hank 1976, Rast et al. 1973). However, in practice, the relationship between tree grades and log grades is less than evident, because log-grading standards can be rather different across mills. As a general guideline, the rough correlation between the two based on diameter, log length, and number of clear sides for sawlogs is (adapted from https://sunrisesawmill.com/):

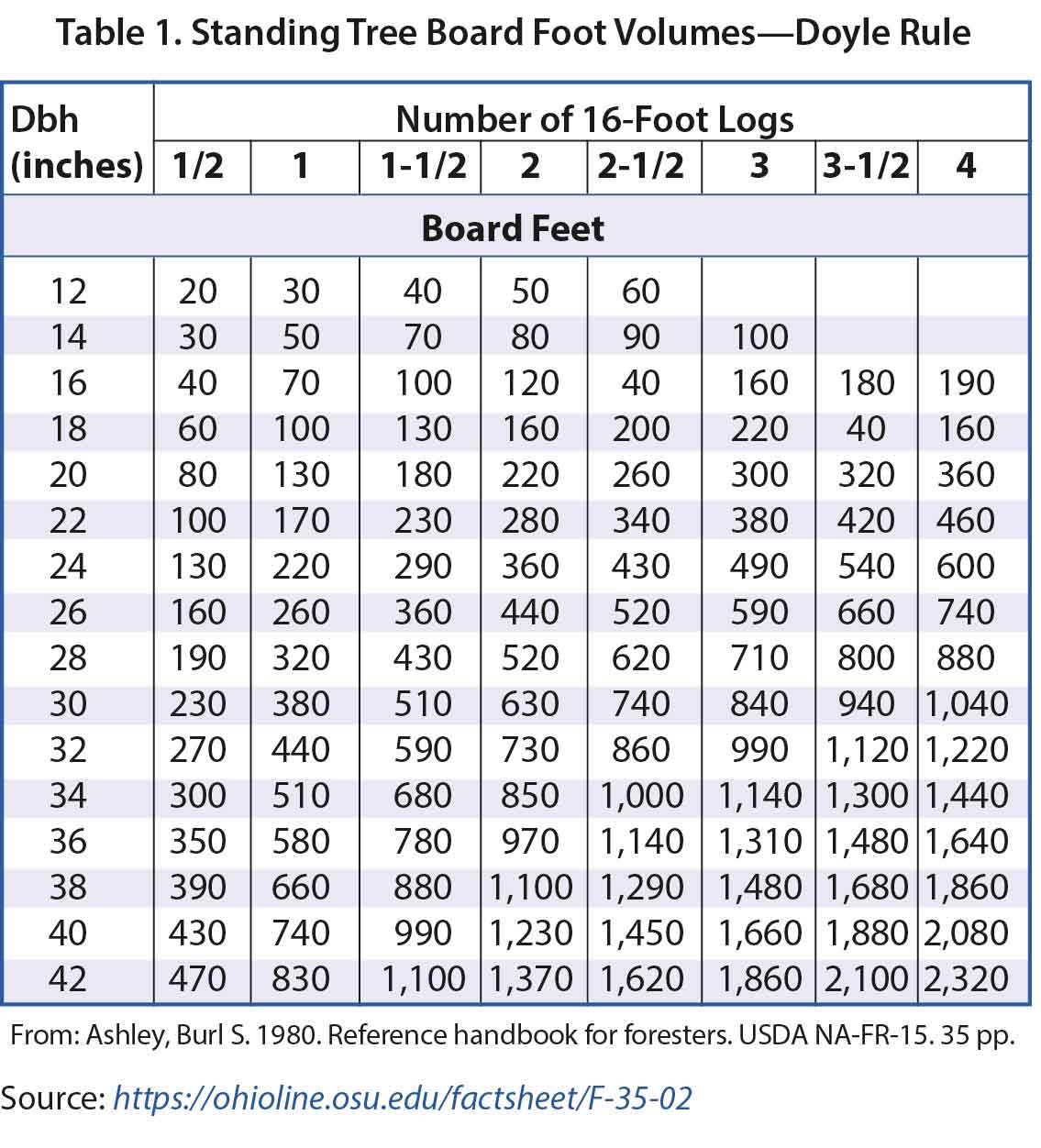

For example, a black walnut tree which has four clear sides, is 24’’ in diameter, and is estimated to produce one 16-feet log is expected to have 220 board feet (Doyle rule) in merchantable sawlog volume of Prime grade. Readers are referred to the table at the end this article for standing tree volumes. The nominal delivered log price of prime-grade black walnut in 2018 was roughly $2,000 per MBF, i.e., $2 per board feet. Thus, at the lower end of log & hauling costs, the estimated stumpage value of such of a tree with a zero profit margin is (2 – 0.225) × 220 = $390, while at the higher end, it is: (2 – 0.275) × 220 = $380. Assuming a profit margin of 5% for timber buyers, the actual price paid may fall in the range of $360 to $370.

A relatively good idea of the estimated worth of standing trees on a property is an important piece of information to have on hand, before timber sale. Verifying one’s own estimate with a professional forester is highly recommend. It is also critical to take the estimated worth of trees into consideration when making forest management plans. Bigger diameter, higher quality trees can be worth much more, hence investments to improve timber stand quality and growing high quality trees to larger diameters usually generate considerable returns in the future. Stumpage prices fluctuate over time, as delivered log prices, and are often in sync with business cycles. Therefore, when stumpage prices are low, it often makes sense to let the trees grow on the stump until prices recover. It is critical to remember that the price reports we see today do not reflect the actual marketplace for timber, as the information is already out of date. They can be used for comparison, and deriving relative value estimates, but should not be considered an accurate picture of current market value. Landowners are recommended to use services of a professional forester for valuation of standing timber when accuracy is important, such as establishing basis, information for settlement of an estate, or investment decisions.

References:

Hanks, Leland F. 1976. Hardwood Tree Grades for Factory Lumber. USDA Forest Service Research Paper NE-333.

IDNR. https://www.in.gov/dnr/forestry/files/fo-2019SpringPriceReport.pdf

Rast, D. E., D. L. Senderman and G. L. Gammon. 1973. A Guide to Hardwood Log Grading. USDA Forest Service General Technical Report, NE1. 31 pages.

Mo Zho is an Assistant Professor of Forest Economics and Management in the Department of Forestry and Natural Resources at Purdue University. Dr. Zhou is also the co-director of the Forest Advanced Computing & Artificial Intelligence (FACAI) Lab. Jeff Settle is the Forest Products Specialist with the IDNR Division of Forestry. Lenny Farlee is an extension forester with the Hardwood Tree Improvement and Regeneration Center, Purdue University Department of Forestry and Natural Resources. Ron Rathfon serves as Purdue University’s extension forester in southwest Indiana located at the Southern Indiana Purdue Agricultural Center (SIPAC) in Dubois County.