2016 Indiana Consulting Foresters Stumpage Timber Price Report

This stumpage report is provided annually and should be used in association with the Indiana Forest Products Price Report and Trend Analysis. Stumpage prices were obtained via a survey to all known professional consulting foresters operating in Indiana. Reported prices are for sealed bid timber sales only (not negotiated sales) between a motivated timber seller and a licensed Indiana timber buyer. The data represents approximately 10 to 15 percent of the total volume of stumpage purchased during the periods from April 16, 2015 through April 15, 2016. This report has been published since 2001.

The results of the stumpage price survey are not meant as a guarantee that amounts offered for your timber will reflect the range in prices reported in this survey. The results simply provide an additional source of information to gauge market conditions

The prices reported are broken into three sale types; high quality, average quality, and low quality. A high quality sale has more than 50 percent of the volume in # 2 or better red oak, white oak, sugar maple, black cherry, or black walnut. The low quality sale has more than 70 percent of the volume in # 3 (pallet) grade or is cottonwood, beech, elm, sycamore, hackberry, pin oak, aspen, black gum, black locust, honey locust, catalpa, or sweet gum. The average sale is a sale that is not a low quality or a high quality sale as defined above.

In the 2008 report some minor adjustments were made in the categories from the previous surveys. White ash was previously included as a component of the high quality sales and hickory was previously in the low quality group. No changes have been made in the categories so the 2016 data should compare well with the data collected since 2008.

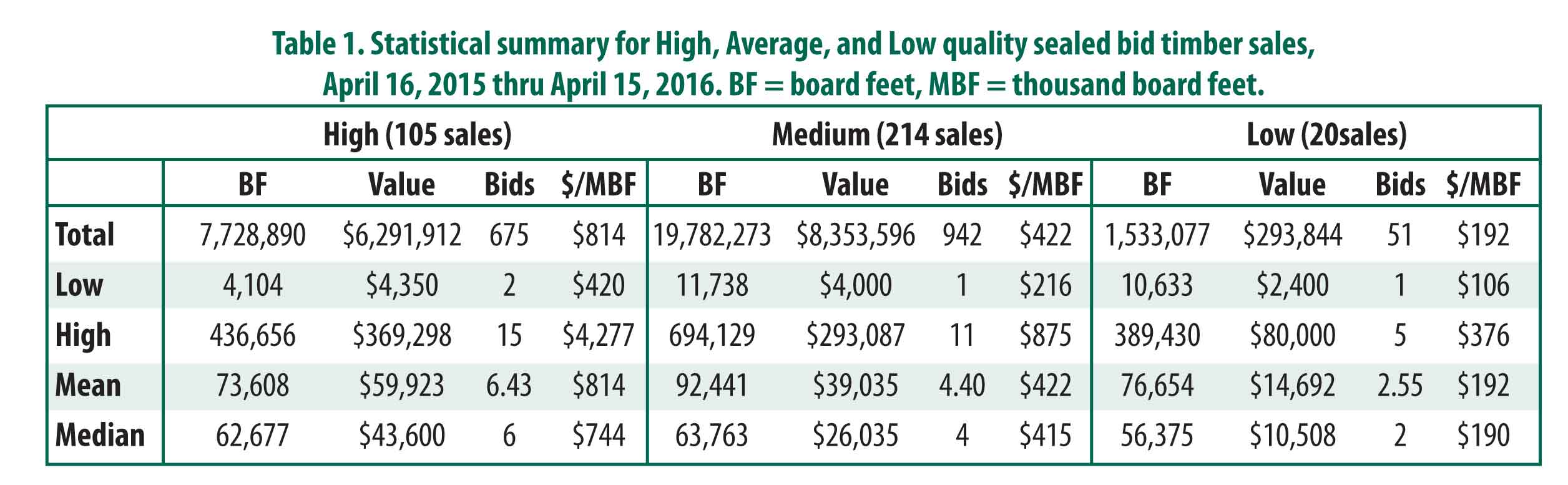

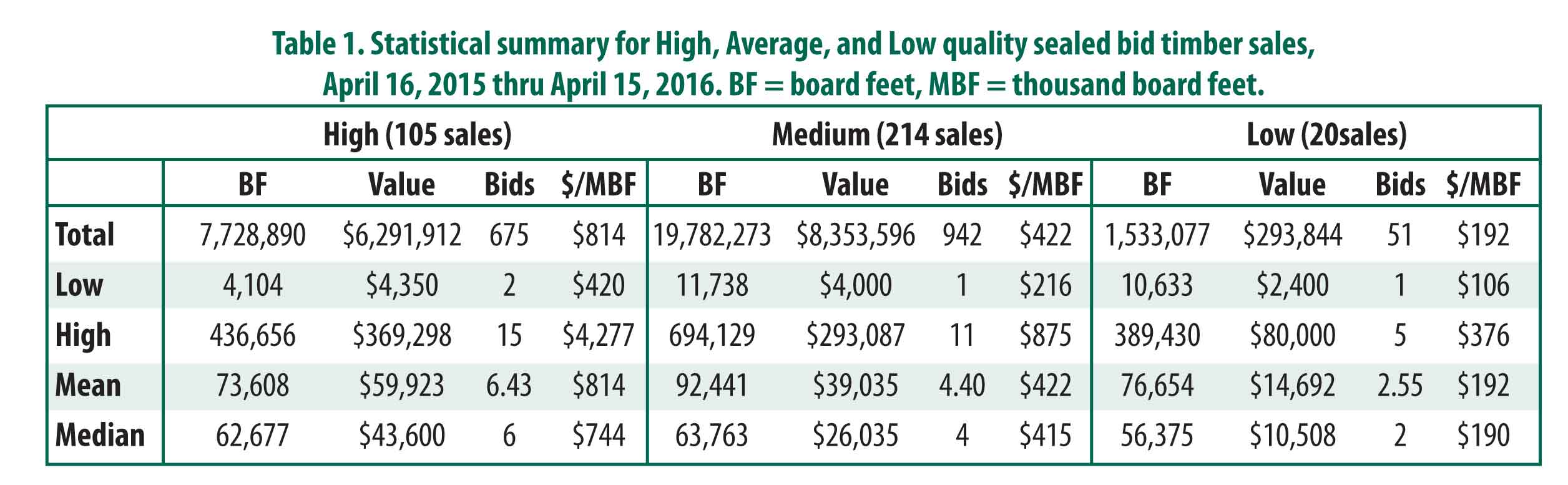

SALE ACTIVITY STAYS HIGH: In 2016, there were 339 sales (plus 20 negotiated sales) which is down slightly from the record 368 sale (plus 12 negotiated) in 2015 but similar to the 330 sales (plus 14 negotiated) reported in 2014 (Table 1 on page 3).

The same 18 consulting firms that reported in 2015 also reported in 2016. Fourteen of the 18 firms have reported every year since 2011. The data from these 14 firms represents 95 percent of the total sales reported; therefore, the data should be very consistent. The high number of sales for the last three years is due to the relatively strong timber markets and an increase in the landowner’s awareness of forest health concerns, particularly emerald ash borers.

VOLUME of TIMBER SOLD: The total stumpage volume sold declined to 29,044,240 board feet (plus an additional 1,257,863 board feet in negotiated sales) from the record high reported of 36,773,866 board feet (plus 683,235 board feet in negotiated sale) reported in 2015. This volume, however, is very consistent with the volumes sold in 2014 and 2013 (28,931,192 bd.ft. and 28,650,085 bd.ft., respectively). Historically the average amount sold each year had been around 25 million board feet with the exception of the recession years in 2009-10.

The volume for the high quality sale totaled 7,728,890 board feet which is considerably lower than the 11,861,259 board feet sold reported in 2015 but only slightly lower than the 8.5 to 8.7 million board feet reported between 2011 and 2014. The decline in the volume in high quality sales may be due to the foresters need to salvage ash killed by emerald ash borers or tulip mortality in southern Indiana which moved those sales into the medium quality category.

The medium quality sales totaled 19,782,273 board feet which is down from the 22,606,525 board feet reported in 2015 but up from the 17,690,376 board feet reported in 2014. The past increases in the volume of medium quality sales has been due to the shifting of ash from high quality to medium quality and hickory from low quality to medium quality in 2008. The impact of the ash has likely had more influence due to the increased amount of ash on the market due to mortality or pending mortality caused by emerald ash borers.

Lower quality sales declined to 1,533,077 board feet from 2,486,082 board feet and 2,657,366 board feet in 2015 and 2014, respectively. The volume of lower quality sales has generally been around 3 million board feet. The decline may also be due in part to the result of more ash being on the market and an increase in sales salvaging tulip mortality which would shift the sales into the medium category.

VALUE of TIMBER SOLD: Total timber value sold in the 2016 reporting period declined to $14,939,352 from the record high of $19,207,898 reported in 2015. Although lower than 2015, the 2016 value is still $2.5 million higher than all other values reported since the survey began in 2001. The high quality sales brought $7,728,890, the medium quality sales $8,353,596, and the low quality sales $293,844.

HIGH QUALITY SALES GET MORE INTEREST: In 2016, a total of 1,668 bids were received on the 339 sales for an average of 5.14 bids per sale. This is somewhat higher than the 4.62 bids per sale received in 2015 and 2014. The majority of this increase was on the high quality sales which increased to 6.43 bids compared to 5.82 bids in 2015 and 5.85 bids in 2014. The 4.40 bids this year on the medium quality sale was slightly higher than the 4.24 bids in 2015 and very similar 4.43 bids in 2014. The number of bidders on the low quality sales decreased to 2.55 bids this year from 2.89 bids in 2015 and 2014.

The increased number of bids on the higher quality sales reflects the strong market for the better quality timber. This increase is also visible in the higher price obtained for the high quality timber. The drop in the number of bids on the low quality sales is also reflected in the low prices reported.

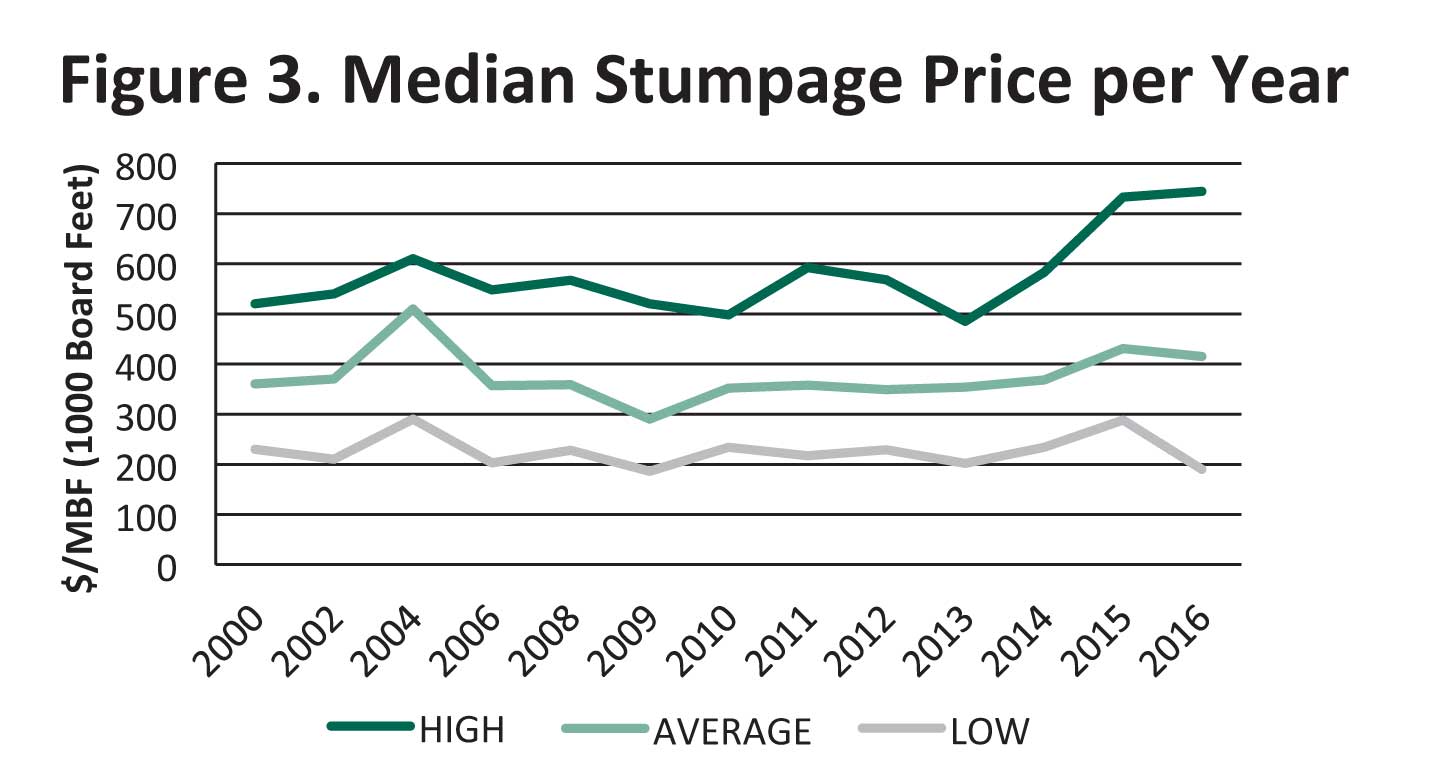

STUMPAGE PRICES: The average stumpage price for all the sales reported was $514/MBF which is the second highest value reported down only slightly from $522/MBF reported in 2015. The only category with an increase was the high quality sales with an average stumpage value of $814/MBF (median value of $744/MBF) which is an increase from the previous average high of $750/MBF in 2015 (median = $733/MBF). The main reason for this increase is the high value of black walnut. The average stumpage price for the medium quality sales is $422/MBF (median value $415/MBF) which is also $8 less per MBF than the average stumpage value of $430/MBF reported in 2015 which was only slightly less than the highest average stumpage price $433 reported in 2004. The average stumpage value for the low quality category declined significantly to $192/MBF (median value $190/MBF) from a record $290/MBF reported in 2015. Although this shows a large decrease in the price for low quality sales, the range for the stumpage price has generally been between $200-$230/MBF since 2001. Although pallet prices have dropped from those reported last year the low number of low quality sales reported and a few larger very low quality sales likely had a significant impact on the value being so low.

This year there were 31 sales (9.2%) that brought over $1.00 per board foot. This number is fairly close to the 36 sales (9.8%) reported in 2015 which is higher than in the past. This increase is largely attributed to the high prices associated with black walnut and white oak. These very high value sales are generally outliers that may distort the stumpage value for most woods.

Landowners should keep in mind that markets are only one factor to consider when selling timber. The condition of the tree is one of the most important factors that determine when is the right time to sell a specific tree (is the tree increasing in value or declining – is the trees condition (health and vigor) going to decline, stay the same, or improve). Sell trees based on their problems or lack of potential than their value. Sell your good trees when they have reached their peak. Another factor to consider is what impact that tree will have on the health, vigor, and resiliency of the future stand (is it competing with a better future crop tree or will it benefit or negatively impact natural regeneration, etc.). Although this report shows a decline in the stumpage value for the lower quality sales, these sales are generally improvement harvests and the opportunity cost in lost productivity of the remaining forest by delaying these sales is usually much higher than a slightly lower price received for the timber.

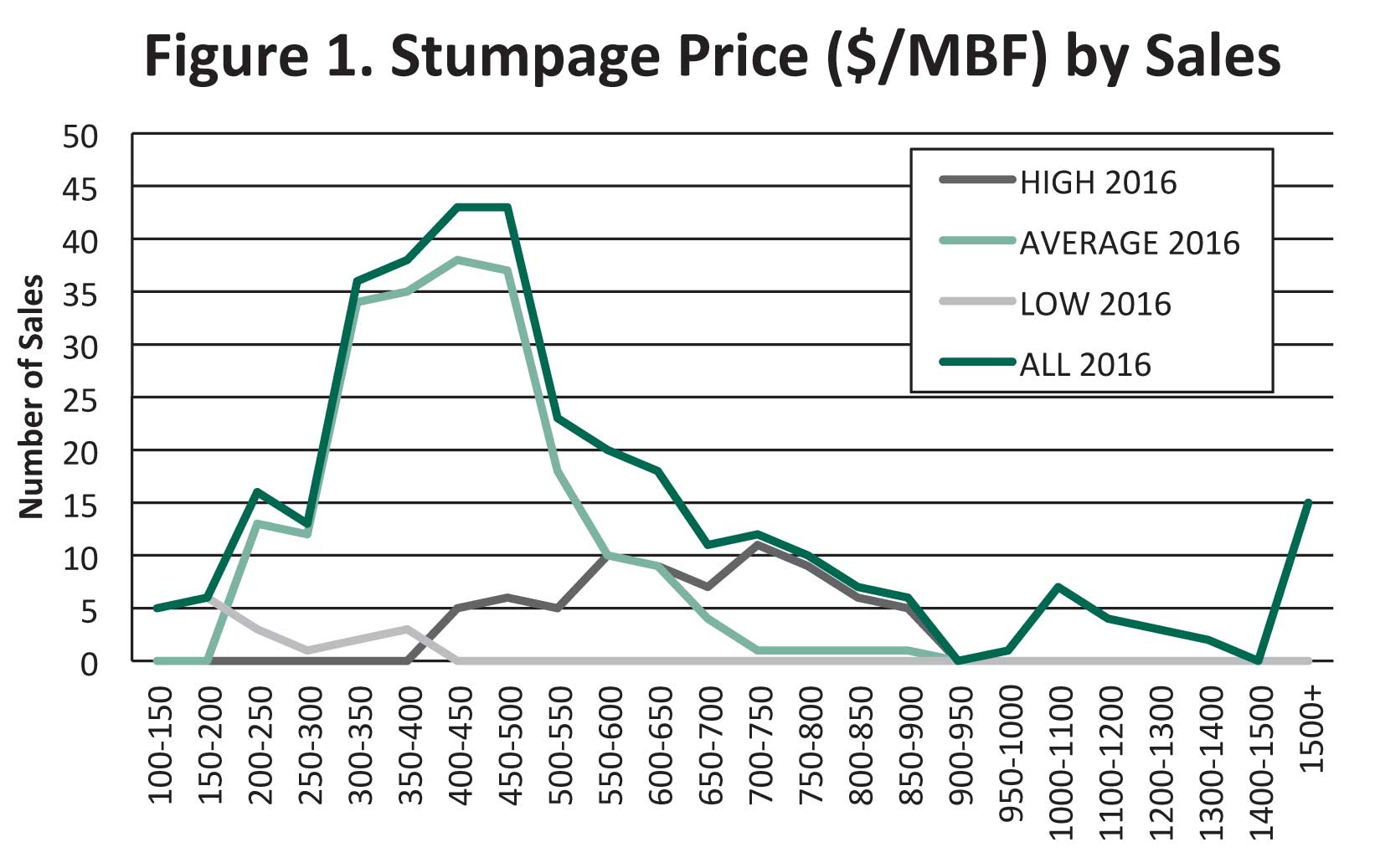

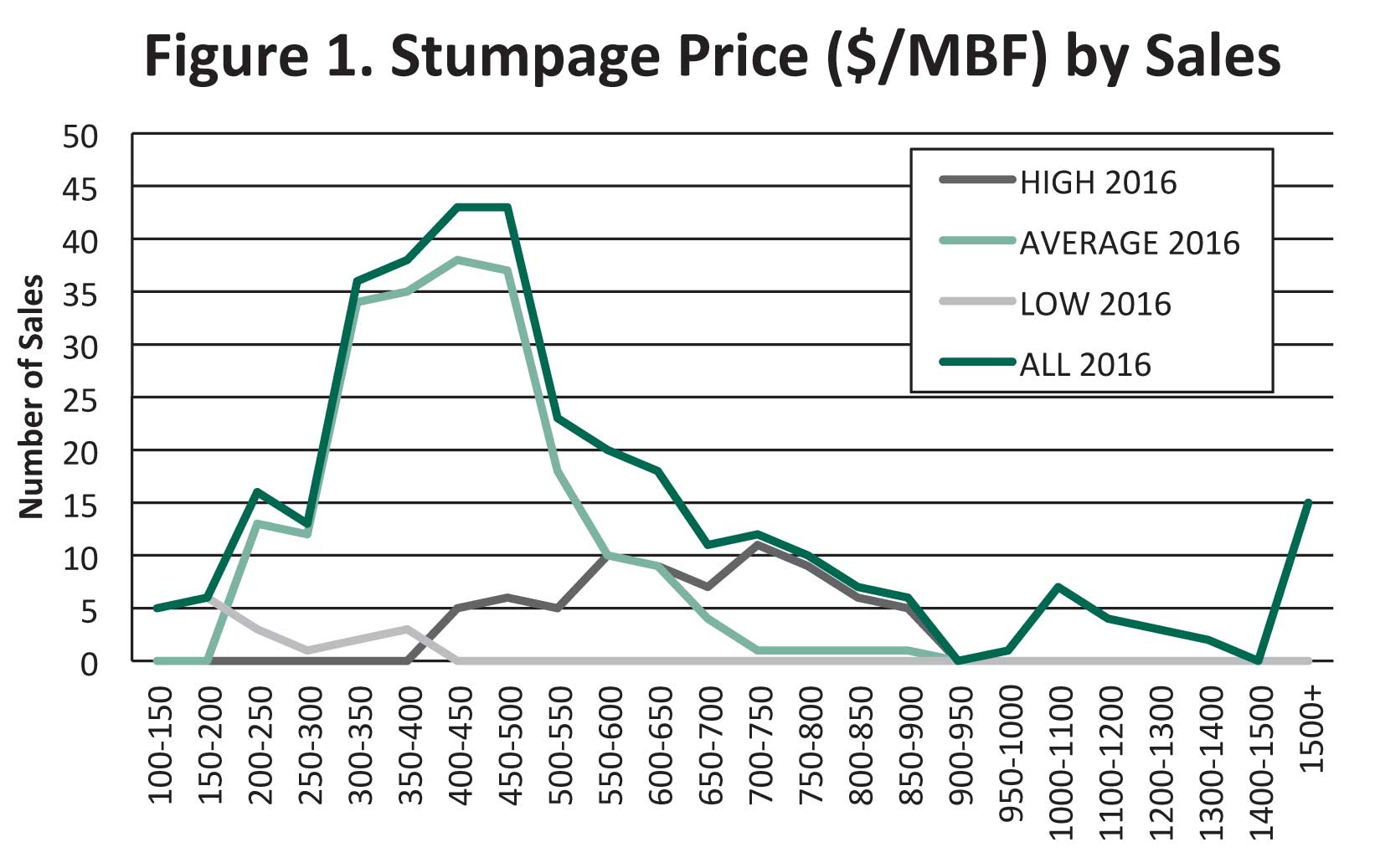

Figure 1 shows the stumpage prices for all sales, high quality sales, medium quality sales, and low quality sales held between April 16, 2015 and April 15, 2016. The data shows a nice bell curve for medium quality and all sales. The bell curve indicates the range in values that most sales fall into and is generally consistent from year to year.

All sales—low, medium and high quality—can be affected by sales with potential veneer or by the presence of a few high value trees, particularly black walnut and white oak. It is important for landowners reading this report to realize their timber typically will fall within the range of stumpage prices but probably will not fall into the outlying values. This makes it important to work with a professional who works for you when selling timber so that you know exactly what you have.

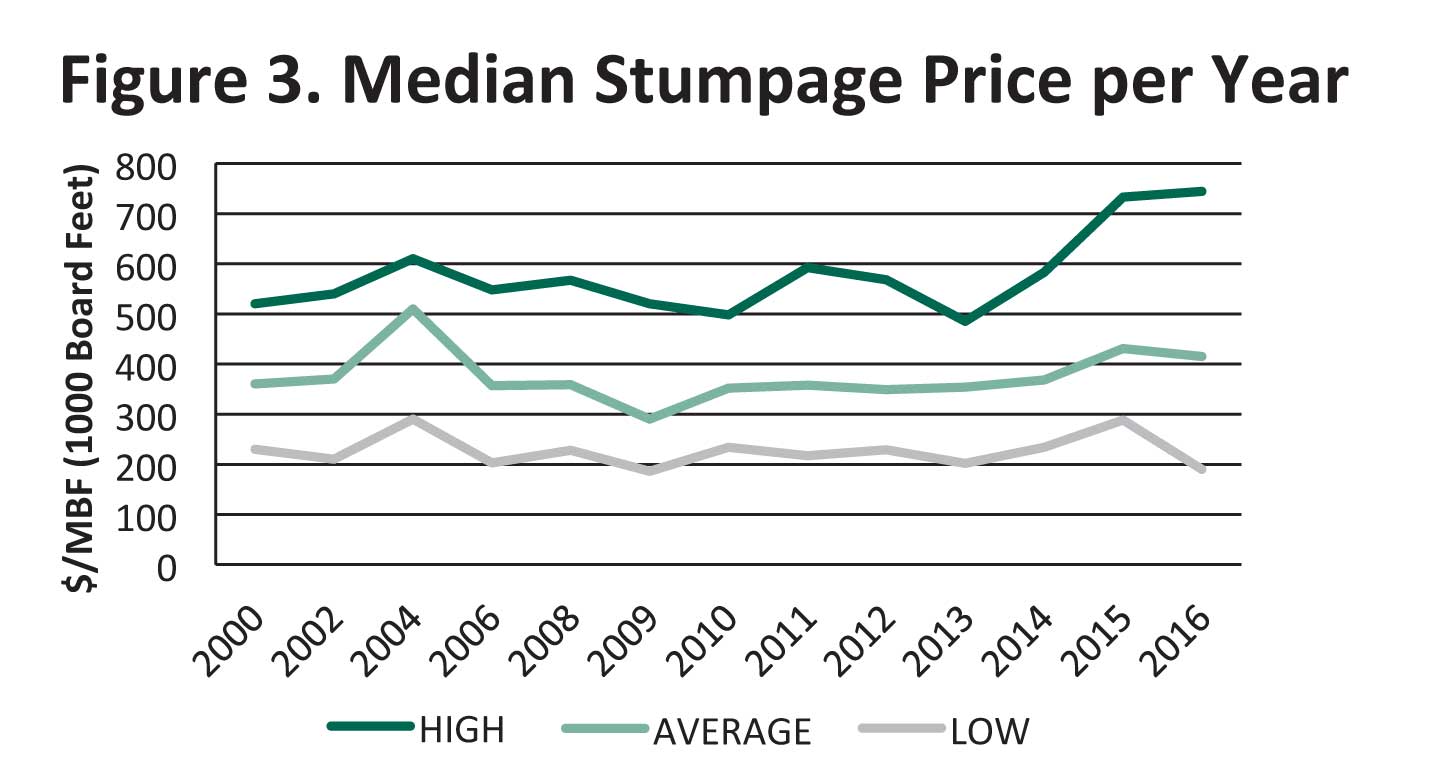

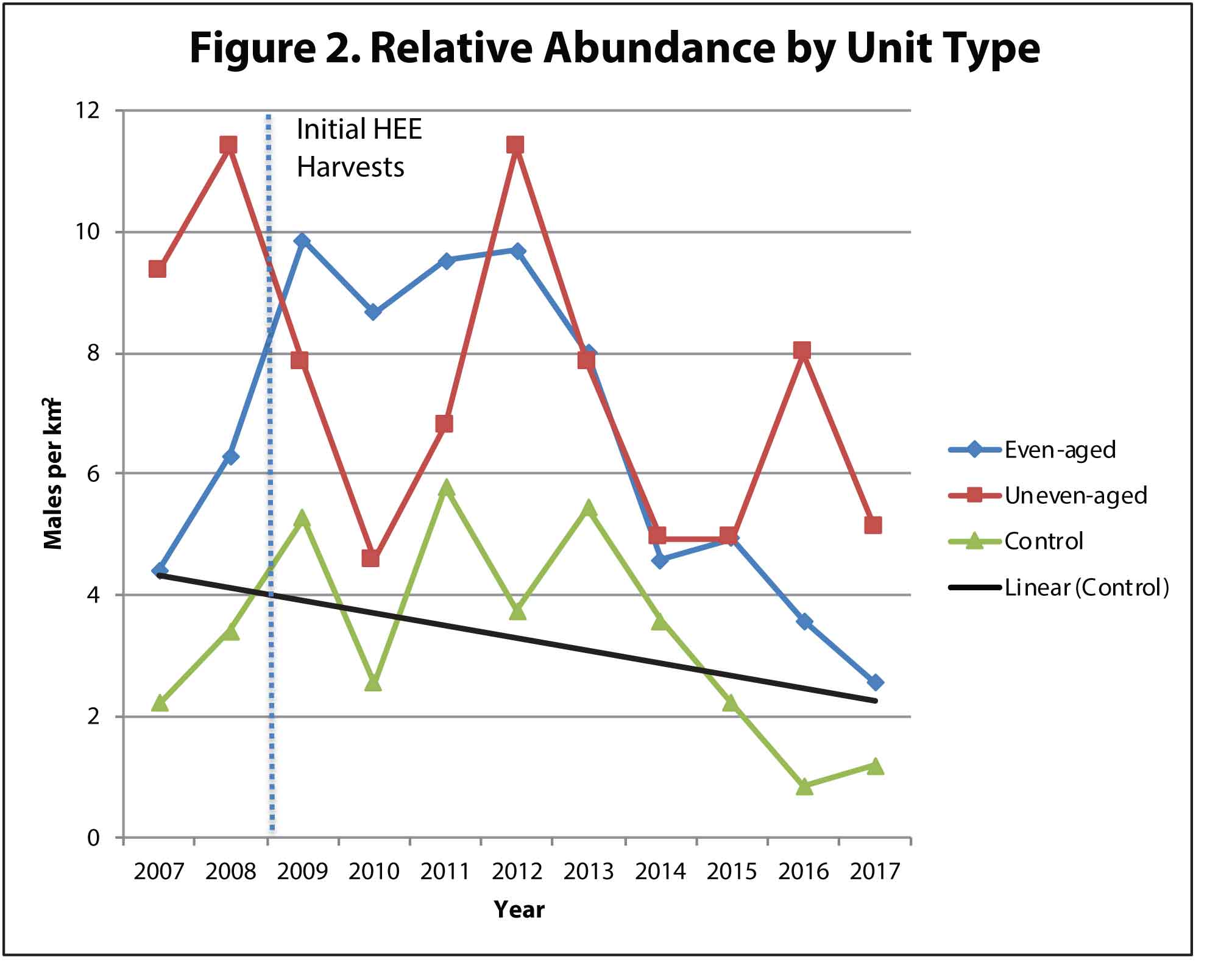

The weighted average stumpage price by sale type (obtained from this survey in 2000, 2002, 2004, 2006, 2008-16) is reported in Figure 2. The weighted average of the stumpage price is the total dollar value for each sales category. The median stumpage price per year for each sales category is reported in Figure 3. The median price is the amount where half of the sales are higher and half are lower. The price reported is per 1000 board feet ($/MBF) for standing timber.

COMMENTS: Standing timber prices often vary during the year and can change rapidly based on supply and demand. The prices are influenced by many factors including tree species, the tree quality and size, where you are in the state, the distance to a sawmill, the access and accessibility of the trees, the size of the harvest, the terms of the sale, etc. This report and the comments below are merely a snapshot in time. It is therefore important to work with a professional forester to get an up-to-the-minute view of the existing markets.

• Black walnut prices, especially for larger trees were very strong throughout 2015. Late last year and this spring walnut prices were still good but demand seemed to be slowing – This is often the case as the supply has meant the demand. Demand often peaks in late summer and early fall.

• White oak (species) prices, especially for the larger trees, were very strong throughout 2015. White oak, especially the stave market has been in high demand and is moving great this year. One consultant commented that white oak prices were the highest I’ve seen in the 15 years that I have been selling timber.

• Red oak, especially larger, higher quality trees have been in good demand. Another consultant reported that markets and prices for red oak are generally good but the market is still volatile.

• Sugar maple markets are generally good in the northern part of the state. The site and the area has a huge influence on how white the wood is and the subsequent price.

• Soft maple continues to move well.

• Black cherry markets are still down and may not return to the high prices of the past for a long time.

• Tulip Poplar has dropped slightly from last year but still seems to be moving well and brings a good price.

• Ash – Emerald ash borers are now present throughout the state with the tree quality and price dependant on how long the trees have been infested or how long they have been dead. Overall the market in southern Indiana is still good.

GENERAL MANAGEMENT COMMENTS: Several of these comments have been made in years past but they are still very true today.

• 1.) Manage your woodland - have a plan, know what you have, and what you need to do, timber is valuable, and taxes are low, 2.) Grow quality, 3.) If you want the best price and want to leave timber for the future, then hire a consulting forester and 4.) Don’t plow or blacktop the access road and expect to get your timber out of the log yard to the county road.

• Access and terms are very important when selling timber. Timber sales that had year round harvest access were in high demand and were of higher value to buyers. Limitations to access such as “no harvesting during deer hunting season” or “no access when crops are in the field” will reduce bidders and result in lower bids. Give access strong consideration. In most cases the higher income from the timber will be more than the income lost from the acre or so of crops

• Invasive plants (bush honeysuckle, ailanthus) continue to spread. Too many stands are being cut without pre-harvest control (poor planning) and the stand is overrun within a year or two of the harvest, negatively impacting the long term health and productivity of the woods. Invasive species need to be controlled prior to any harvesting. Cost share assistance may be available to control the invasive plants thru the local Natural Resource Conservation Service office.

• Foresters are recommending that landowners think ahead and bring invasive plant problems under control prior to harvesting timber. I am behind on my marking jobs mainly due to the number of invasive species or brush management removal jobs I have had for clients. Fortunately more landowners are reinvesting a percentage of their timber sale income back into the woods in the form of forest stand improvement, tree planting, and invasive species control.

• Seeing a lot more high graded woods with young walnuts cut prematurely.

• Seeing too many diameter limit harvests with trees cut too early. Tree size is not a reason to harvest the tree and trees mature at different sizes on different sites.

• Woodland clearing (converting to cropland) is still too prevalent. With the decline in crop prices it is happening way too often, especially on marginal soils.

Consulting Foresters that have contributed to this report in alphabetically order include: Arbor Terra Consulting (Mike Warner), Crowe Forest Management LLC (Tom Crowe and Jacob Hougham), Christopher Egolf, Gandy Timber Management (Brian Gandy), Glen Summers, Gregg Forestry Services (Mike Gregg), Habitat Solutions LLC (Dan McGuckin), Haney Forestry, LLC (Stu Haney), Multi-Resource Management, Inc. (Thom Kinney and Doug Brown), Meisberger Woodland Management (Dan Meisberger), Pyle Timber Sales and Management (David Pyle), Quality Forest Management, Inc (Justin Herbaugh), Ratts Forestry (Chuck Ratts), Schuerman Forestry and Bear Forestry (Joe Schuerman and Abe Bear), Stambaugh Forestry (John Stambaugh), Steinkraus Forest Management, LLC (Jeff Steinkraus), Turner Forestry, Inc. (Stewart Turner), and Wakeland Forestry Consultants, Inc. (Bruce Wakeland, Mike Denman, Andrew Suseland).

2016 Indiana Consulting Foresters Stumpage Timber Price ReportThis stumpage report is provided annually and should be used in association with the Indiana Forest Products Price Report and Trend Analysis. Stumpage prices were obtained via a survey to all known professional consulting foresters operating in Indiana. Reported prices are for sealed bid timber sales only (not negotiated sales) between a motivated timber seller and a licensed Indiana timber buyer. The data represents approximately 10 to 15 percent of the total volume of stumpage purchased during the periods from April 16, 2015 through April 15, 2016. This report has been published since 2001. The results of the stumpage price survey are not meant as a guarantee that amounts offered for your timber will reflect the range in prices reported in this survey. The results simply provide an additional source of information to gauge market conditionsThe prices reported are broken into three sale types; high quality, average quality, and low quality. A high quality sale has more than 50 percent of the volume in # 2 or better red oak, white oak, sugar maple, black cherry, or black walnut. The low quality sale has more than 70 percent of the volume in # 3 (pallet) grade or is cottonwood, beech, elm, sycamore, hackberry, pin oak, aspen, black gum, black locust, honey locust, catalpa, or sweet gum. The average sale is a sale that is not a low quality or a high quality sale as defined above. In the 2008 report some minor adjustments were made in the categories from the previous surveys. White ash was previously included as a component of the high quality sales and hickory was previously in the low quality group. No changes have been made in the categories so the 2016 data should compare well with the data collected since 2008. SALE ACTIVITY STAYS HIGH: In 2016, there were 339 sales (plus 20 negotiated sales) which is down slightly from the record 368 sale (plus 12 negotiated) in 2015 but similar to the 330 sales (plus 14 negotiated) reported in 2014 (Table 1 on page 3).The same 18 consulting firms that reported in 2015 also reported in 2016. Fourteen of the 18 firms have reported every year since 2011. The data from these 14 firms represents 95 percent of the total sales reported; therefore, the data should be very consistent. The high number of sales for the last three years is due to the relatively strong timber markets and an increase in the landowner’s awareness of forest health concerns, particularly emerald ash borers. VOLUME of TIMBER SOLD: The total stumpage volume sold declined to 29,044,240 board feet (plus an additional 1,257,863 board feet in negotiated sales) from the record high reported of 36,773,866 board feet (plus 683,235 board feet in negotiated sale) reported in 2015. This volume, however, is very consistent with the volumes sold in 2014 and 2013 (28,931,192 bd.ft. and 28,650,085 bd.ft., respectively). Historically the average amount sold each year had been around 25 million board feet with the exception of the recession years in 2009-10. The volume for the high quality sale totaled 7,728,890 board feet which is considerably lower than the 11,861,259 board feet sold reported in 2015 but only slightly lower than the 8.5 to 8.7 million board feet reported between 2011 and 2014. The decline in the volume in high quality sales may be due to the foresters need to salvage ash killed by emerald ash borers or tulip mortality in southern Indiana which moved those sales into the medium quality category. The medium quality sales totaled 19,782,273 board feet which is down from the 22,606,525 board feet reported in 2015 but up from the 17,690,376 board feet reported in 2014. The past increases in the volume of medium quality sales has been due to the shifting of ash from high quality to medium quality and hickory from low quality to medium quality in 2008. The impact of the ash has likely had more influence due to the increased amount of ash on the market due to mortality or pending mortality caused by emerald ash borers. Lower quality sales declined to 1,533,077 board feet from 2,486,082 board feet and 2,657,366 board feet in 2015 and 2014, respectively. The volume of lower quality sales has generally been around 3 million board feet. The decline may also be due in part to the result of more ash being on the market and an increase in sales salvaging tulip mortality which would shift the sales into the medium category. VALUE of TIMBER SOLD: Total timber value sold in the 2016 reporting period declined to $14,939,352 from the record high of $19,207,898 reported in 2015. Although lower than 2015, the 2016 value is still $2.5 million higher than all other values reported since the survey began in 2001. The high quality sales brought $7,728,890, the medium quality sales $8,353,596, and the low quality sales $293,844. HIGH QUALITY SALES GET MORE INTEREST: In 2016, a total of 1,668 bids were received on the 339 sales for an average of 5.14 bids per sale. This is somewhat higher than the 4.62 bids per sale received in 2015 and 2014. The majority of this increase was on the high quality sales which increased to 6.43 bids compared to 5.82 bids in 2015 and 5.85 bids in 2014. The 4.40 bids this year on the medium quality sale was slightly higher than the 4.24 bids in 2015 and very similar 4.43 bids in 2014. The number of bidders on the low quality sales decreased to 2.55 bids this year from 2.89 bids in 2015 and 2014. The increased number of bids on the higher quality sales reflects the strong market for the better quality timber. This increase is also visible in the higher price obtained for the high quality timber. The drop in the number of bids on the low quality sales is also reflected in the low prices reported. STUMPAGE PRICES: The average stumpage price for all the sales reported was $514/MBF which is the second highest value reported down only slightly from $522/MBF reported in 2015. The only category with an increase was the high quality sales with an average stumpage value of $814/MBF (median value of $744/MBF) which is an increase from the previous average high of $750/MBF in 2015 (median = $733/MBF). The main reason for this increase is the high value of black walnut. The average stumpage price for the medium quality sales is $422/MBF (median value $415/MBF) which is also $8 less per MBF than the average stumpage value of $430/MBF reported in 2015 which was only slightly less than the highest average stumpage price $433 reported in 2004. The average stumpage value for the low quality category declined significantly to $192/MBF (median value $190/MBF) from a record $290/MBF reported in 2015. Although this shows a large decrease in the price for low quality sales, the range for the stumpage price has generally been between $200-$230/MBF since 2001. Although pallet prices have dropped from those reported last year the low number of low quality sales reported and a few larger very low quality sales likely had a significant impact on the value being so low. This year there were 31 sales (9.2%) that brought over $1.00 per board foot. This number is fairly close to the 36 sales (9.8%) reported in 2015 which is higher than in the past. This increase is largely attributed to the high prices associated with black walnut and white oak. These very high value sales are generally outliers that may distort the stumpage value for most woods. Landowners should keep in mind that markets are only one factor to consider when selling timber. The condition of the tree is one of the most important factors that determine when is the right time to sell a specific tree (is the tree increasing in value or declining – is the trees condition (health and vigor) going to decline, stay the same, or improve). Sell trees based on their problems or lack of potential than their value. Sell your good trees when they have reached their peak. Another factor to consider is what impact that tree will have on the health, vigor, and resiliency of the future stand (is it competing with a better future crop tree or will it benefit or negatively impact natural regeneration, etc.). Although this report shows a decline in the stumpage value for the lower quality sales, these sales are generally improvement harvests and the opportunity cost in lost productivity of the remaining forest by delaying these sales is usually much higher than a slightly lower price received for the timber. Figure 1 shows the stumpage prices for all sales, high quality sales, medium quality sales, and low quality sales held between April 16, 2015 and April 15, 2016. The data shows a nice bell curve for medium quality and all sales. The bell curve indicates the range in values that most sales fall into and is generally consistent from year to year. All sales—low, medium and high quality—can be affected by sales with potential veneer or by the presence of a few high value trees, particularly black walnut and white oak. It is important for landowners reading this report to realize their timber typically will fall within the range of stumpage prices but probably will not fall into the outlying values. This makes it important to work with a professional who works for you when selling timber so that you know exactly what you have. The weighted average stumpage price by sale type (obtained from this survey in 2000, 2002, 2004, 2006, 2008-16) is reported in Figure 2. The weighted average of the stumpage price is the total dollar value for each sales category. The median stumpage price per year for each sales category is reported in Figure 3. The median price is the amount where half of the sales are higher and half are lower. The price reported is per 1000 board feet ($/MBF) for standing timber. COMMENTS: Standing timber prices often vary during the year and can change rapidly based on supply and demand. The prices are influenced by many factors including tree species, the tree quality and size, where you are in the state, the distance to a sawmill, the access and accessibility of the trees, the size of the harvest, the terms of the sale, etc. This report and the comments below are merely a snapshot in time. It is therefore important to work with a professional forester to get an up-to-the-minute view of the existing markets.• Black walnut prices, especially for larger trees were very strong throughout 2015. Late last year and this spring walnut prices were still good but demand seemed to be slowing – This is often the case as the supply has meant the demand. Demand often peaks in late summer and early fall. • White oak (species) prices, especially for the larger trees, were very strong throughout 2015. White oak, especially the stave market has been in high demand and is moving great this year. One consultant commented that white oak prices were the highest I’ve seen in the 15 years that I have been selling timber. • Red oak, especially larger, higher quality trees have been in good demand. Another consultant reported that markets and prices for red oak are generally good but the market is still volatile. • Sugar maple markets are generally good in the northern part of the state. The site and the area has a huge influence on how white the wood is and the subsequent price.• Soft maple continues to move well. • Black cherry markets are still down and may not return to the high prices of the past for a long time.• Tulip Poplar has dropped slightly from last year but still seems to be moving well and brings a good price. • Ash – Emerald ash borers are now present throughout the state with the tree quality and price dependant on how long the trees have been infested or how long they have been dead. Overall the market in southern Indiana is still good. GENERAL MANAGEMENT COMMENTS: Several of these comments have been made in years past but they are still very true today. • 1.) Manage your woodland - have a plan, know what you have, and what you need to do, timber is valuable, and taxes are low, 2.) Grow quality, 3.) If you want the best price and want to leave timber for the future, then hire a consulting forester and 4.) Don’t plow or blacktop the access road and expect to get your timber out of the log yard to the county road.• Access and terms are very important when selling timber. Timber sales that had year round harvest access were in high demand and were of higher value to buyers. Limitations to access such as “no harvesting during deer hunting season” or “no access when crops are in the field” will reduce bidders and result in lower bids. Give access strong consideration. In most cases the higher income from the timber will be more than the income lost from the acre or so of crops• Invasive plants (bush honeysuckle, ailanthus) continue to spread. Too many stands are being cut without pre-harvest control (poor planning) and the stand is overrun within a year or two of the harvest, negatively impacting the long term health and productivity of the woods. Invasive species need to be controlled prior to any harvesting. Cost share assistance may be available to control the invasive plants thru the local Natural Resource Conservation Service office. • Foresters are recommending that landowners think ahead and bring invasive plant problems under control prior to harvesting timber. I am behind on my marking jobs mainly due to the number of invasive species or brush management removal jobs I have had for clients. Fortunately more landowners are reinvesting a percentage of their timber sale income back into the woods in the form of forest stand improvement, tree planting, and invasive species control. • Seeing a lot more high graded woods with young walnuts cut prematurely. • Seeing too many diameter limit harvests with trees cut too early. Tree size is not a reason to harvest the tree and trees mature at different sizes on different sites. • Woodland clearing (converting to cropland) is still too prevalent. With the decline in crop prices it is happening way too often, especially on marginal soils.

Consulting Foresters that have contributed to this report in alphabetically order include: Arbor Terra Consulting (Mike Warner), Crowe Forest Management LLC (Tom Crowe and Jacob Hougham), Christopher Egolf, Gandy Timber Management (Brian Gandy), Glen Summers, Gregg Forestry Services (Mike Gregg), Habitat Solutions LLC (Dan McGuckin), Haney Forestry, LLC (Stu Haney), Multi-Resource Management, Inc. (Thom Kinney and Doug Brown), Meisberger Woodland Management (Dan Meisberger), Pyle Timber Sales and Management (David Pyle), Quality Forest Management, Inc (Justin Herbaugh), Ratts Forestry (Chuck Ratts), Schuerman Forestry and Bear Forestry (Joe Schuerman and Abe Bear), Stambaugh Forestry (John Stambaugh), Steinkraus Forest Management, LLC (Jeff Steinkraus), Turner Forestry, Inc. (Stewart Turner), and Wakeland Forestry Consultants, Inc. (Bruce Wakeland, Mike Denman, Andrew Suseland).