Property Tax Assessment of Indiana’s Woodlands

By Brenda Huter

Land in Indiana is assessed for property taxes according to how the land is used. Woodlands are no different. Woodlands are typically assessed as either residential or agricultural. The size of the parcel does not determine how the woodland is categorized. Enrollment in the Classified Forest and Wildlands Program can reduce property assessment below residential or agricultural assessment.

Land in Indiana is assessed for property taxes according to how the land is used. Woodlands are no different. Woodlands are typically assessed as either residential or agricultural. The size of the parcel does not determine how the woodland is categorized. Enrollment in the Classified Forest and Wildlands Program can reduce property assessment below residential or agricultural assessment.

Residential: When a woodland is used primarily for residential purposes (home sites, recreation, privacy buffers, wildlife viewing), the woodlot should be assessed as residential or residential excess acreage. There does not have to be a house on the property in order to be assessed as residential. Residential land is assessed by the true market value. True market value is determined by using recent local sales of similar property.

For example, a 20-acre woodland is used as a hunting retreat. Based on recent sales in the vicinity, the market value is $3,000/acre. The assessed value of the residential woodland is 20 acres x $3,000 =$60,000 assessed value.

Agricultural: Woodlands grown to produce timber or other forest products should be assessed as agricultural lands. If the forest is part of a larger farm, it should be assessed as agricultural woodland. If the woods is not part of farm, county assessors may ask for documentation to show that land is being used for an agricultural purpose – records of previous timber sales, a forest management plan listing timber production as a primary goal, contracts with a forester or other forestry professional, and receipts for forest management related products (i.e. herbicide, stone).

The assessed value of an agricultural woodland is determined by multiplying the year’s agricultural base rate by a soil productivity factor (ranges from 0.5 for poorest soils to 1.28 for the best soils) and then reducing the value by an influence factor. Agricultural woodlands receive an 80% influence factor deduction.

For example, a 20 acre woodland is managed for timber according to a forest management plan. The soil has a productivity factor of 0.9. The assessed value of the woodland is calculated below:

20 acres x $2,050a agricultural base/acre x 0.9 soil productivity factor = $36,900

$36,900 - ($36,900 x 0.8 woodland influence factor) = $7,380 assessed value a

This is the agricultural base for 2015.

Classified Forest & Wildlands Program: Landowners can reduce their property taxes by enrolling in the Classified Forest & Wildlands Program. The program, administered by the Indiana Division of Forestry, gives landowners a property tax incentive in return for managing their land according to a professionally written management plan focusing on timber, watershed protection, wildlife habitat, and the owner’s objectives. It currently reduces the assessed value for the enrolled acres to $1/acre. In 2017, the assessed value for classified land will increase to $13.29 and then adjust each year for inflation. To be eligible for the program the property must contain at least 10 contiguous acres of forest, grassland, shrubland and/or wetland. Enrolled land cannot have any buildings, cannot be grazed or used to grow crops. Once classified the status stays with the land until an owner takes it out. There are penalties to remove land from the program: an amount not to exceed the last ten years taxes(taxes that would have been paid if not in the program) plus 10% interest and $50 per acre plus $100 administration fee per withdraw. More information about the Classified Forest & Wildlands Program visit www.in.gov/dnr/forestry/4801.htm.

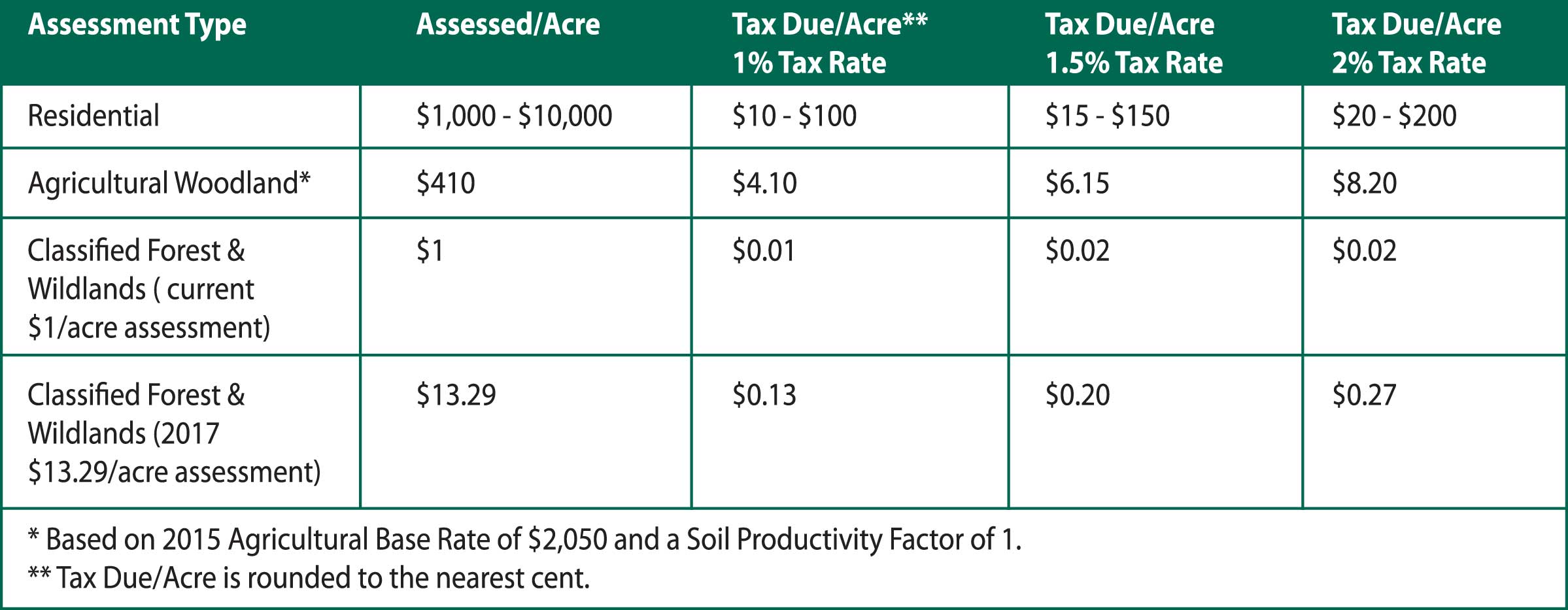

Taxes: Some landowners mistakenly think that the assessed value is the amount of taxes they pay. The amount of tax due is calculated by taking the assessed value by the tax rate. The table below provides examples of tax due for residential, agricultural, and classified land.

Brenda Huter is a Forest Stewardship Coordinator with the Indiana Division of Forestry.