2021 Indiana Consulting Foresters Stumpage Timber Price Report

This report is provided annually and is intended to be used as a general indicator of timber stumpage prices and activity in Indiana. There are many factors that determine the price of any individual timber sale, including tree species and quality, average tree volume, size of sale, ease of operability, access and yarding issues, proximity to markets, region of the State, availability of other timber in the area, number of bidders interested in the sale, season it can be logged, economic forecasts and many more. For this reason, the reported prices should not be considered as a guarantee of the value for any given sale. However, this report can be used as a general trend of timber sale prices, and most sales will probably fall somewhere in the range of reported prices. To best market your timber, it is recommended you contact a consultant forester that can gauge your timber value in your area and markets.

To create the report a survey was made of all known professional consulting foresters in Indiana. Sales were reported from all areas of the State. Prices were reported from sealed bid timber sales (not negotiated sales) between a motivated seller and a licensed Indiana timber buyer. The data represents sales from January 1 to December 31, 2021. The reporting period was changed in this current survey but the survey has been conducted since 2001.

Timber Sale Price Survey

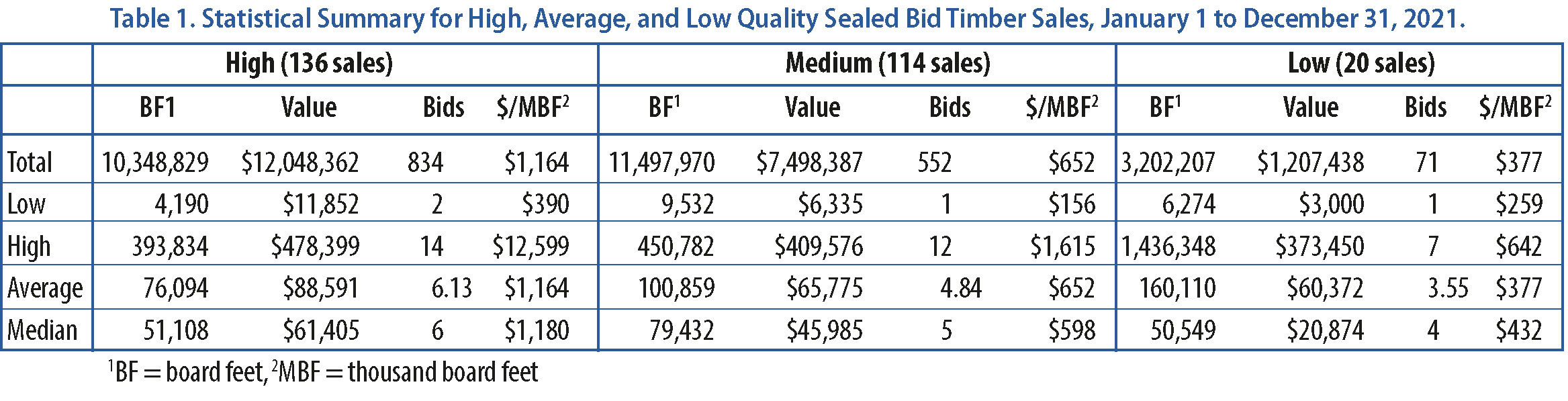

Timber sale categories: As in the past, sales were reported in three categories based on quality. A high-quality sale has more than 50 percent of the volume in #2 or better red oak, white oak, sugar maple, black cherry or black walnut. A low-quality sale has more than 70 percent of the volume in #3 (low or pallet) grade or is cottonwood, beech, elm, sycamore, hackberry, pin oak, aspen, black gum, black locust, honeylocust, catalpa, sweetgum or pine. An average sale is a sale that is neither a high- or low-quality sale.

Survey responses: There were 20 consultants that reported prices this year. This is an increase from the 15 to 18 that reported each year dating back to 2015. Prices were reported from 270 sales which is the highest number reported since 2016 and stops a trend of descending reported sales. Sale volumes totaled 25,049,006 board feet, which is the most reported since 2015 and right at the average over the history of the report. Total sale values, over all three categories, totaled $20,754,187.

High quality sales: There were a total of 136 sales reported by 19 respondents in this category. Sale volumes ranged from a low of 4,190 board feet to a high of 393,834 board feet and averaged 76,094 board feet per sale. The median volume was 51,108 board feet. Overall, the weighted average of these sales was $1.164 per foot. It is worth noting that extremely high prices being paid for walnut and white oak, both veneer and lumber, can cause a wide range of prices between sales depending on the volume and quality of these species. Therefore, the range within this group went from a low of $0.390 to a high of $12.599 per foot. The second highest value of $7.843 indicates how extreme these prices can be.

Medium quality sales: Eighteen consultants reported 114 sales in this category. Sale volumes ranged from 9,532 board feet to 450,782 board feet and averaged 100,859 board feet per sale. The median sale volume was 79,432 board feet. These sales averaged $0.652 per board foot. The range of prices by sale went from a low of $0.156 to a high of $1.615.

Low quality sales: Only 10 consultants reported 20 low quality sales. Sale volumes ranged from a low of 6,274 board feet to a high of 1,436,348 board feet. The average sale was 160,110 board feet but due to the wide range the median volume of 50,549 board feet is probably more realistic. The 20 sale prices ranged from a low of $0.259 to a high of $0.642 and averaged $0.377 per board foot.

Survey Response Discussion

Volume of timber sold: Since the survey only catches a voluntary sampling of the total volume of timber sold, the increase in reporting cannot be definitively used to indicate an increase in the total volume of timber sold. However, most consultants would indicate an increase in the number of calls for timber sale assistance as high prices drove many landowners to consider selling timber. The general feeling is that there was considerably more timber being sold in 2021 than most recent years.

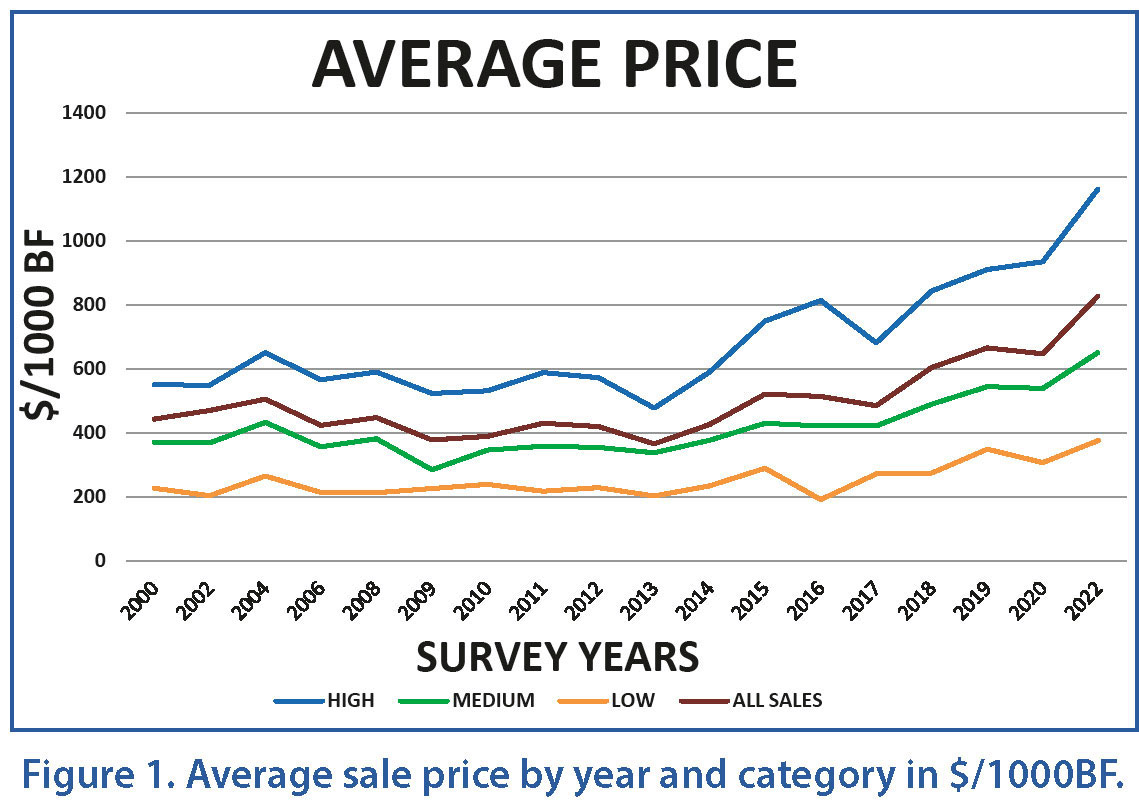

Value of timber sold: Across the board, 2021 prices crushed all the record highs since reporting began in 2001. Over all reported sale categories in 2021, the average price was $0.829 per foot, breaking the previous record of $0.666 set in 2019. This was a 24% increase over the previous record and a 28% increase over the 2020 price of $0.647. The high quality sales saw the largest increase in value. The $1.164 average value in 2021 was a 24% increase over the previous record, set in 2020 at $0.935. The medium quality sales average of $0.652 was a 21% increase over 2020’s $0.539 and a 20% increase over the 2018 previous high of $0.545. The low quality sales saw the smallest increase in value. The 2021 average price of $0.377 was a 23% increase over the 2020 price of $0.307 and an 8% increase over the previous record of $0.349 reported in 2018. See Figure 1.

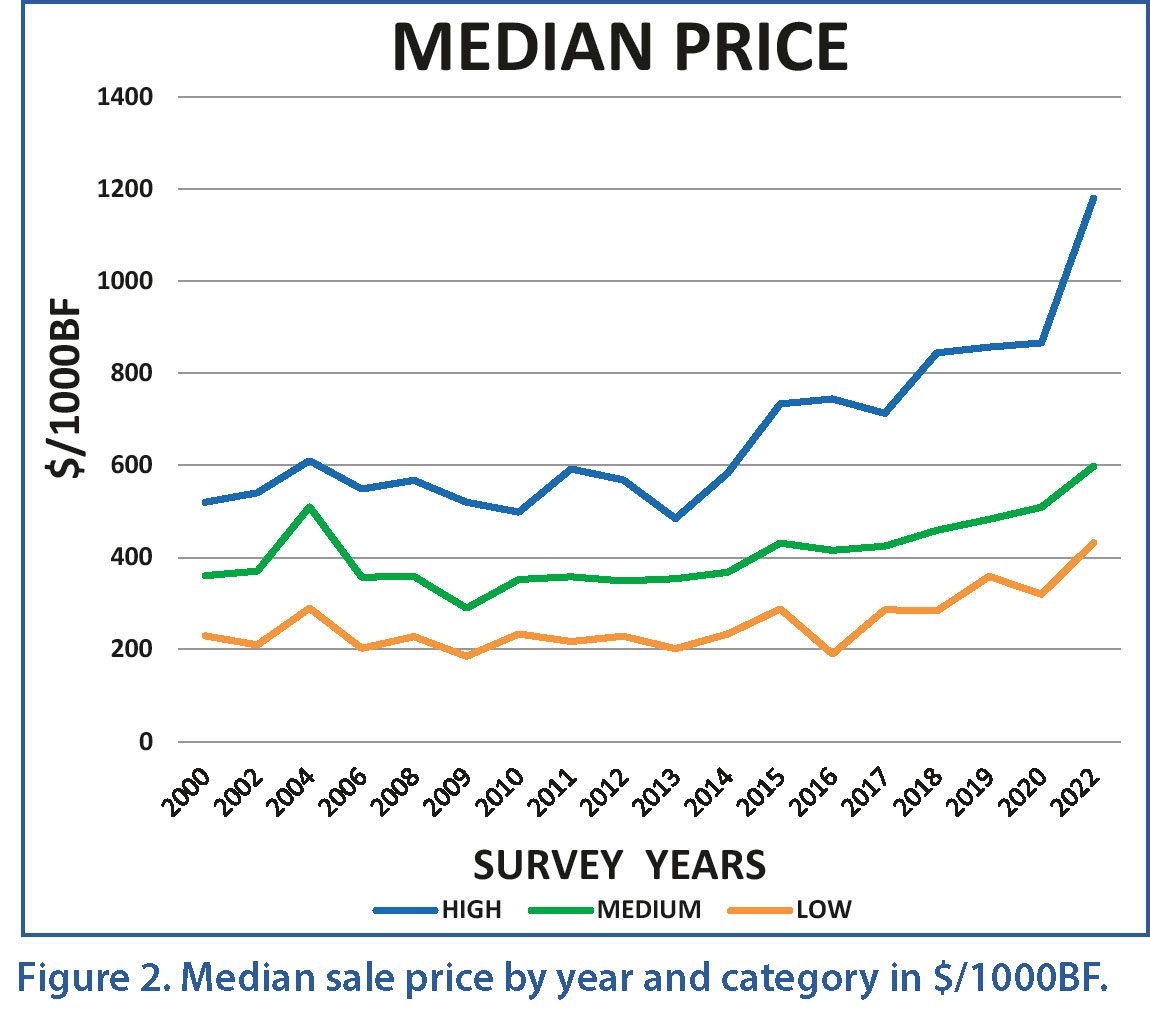

Median values: In contrast to averages, which can be skewed by extremely low or high values, median values are often a better indicator of timber value trends. The median values also indicate record high timber prices since the survey began. For high quality sales the 2021 median price of $1.180 was very close to the average price of $1.164. It also exceeded the previous high median price from 2020 of $0.865. This is a 36% increase. For medium quality sales, the 2021 median price was $0.598, which was considerably less than the average price of $0.652. However, it easily beat the 2020 median price of $0.509. This is a 17% increase. The highest previous median price for medium quality sales was $0.510 in 2004 which is also a 17% increase. For low quality sales the 2021 median price was $0.432. This is considerably more than the average price of $0.377. In 2020 the median price was $0.320. This is an increase of 35%. The 2021 median price for low quality sales is an increase of 20% from the previous high of $0.359 in 2019. See Figure 2.

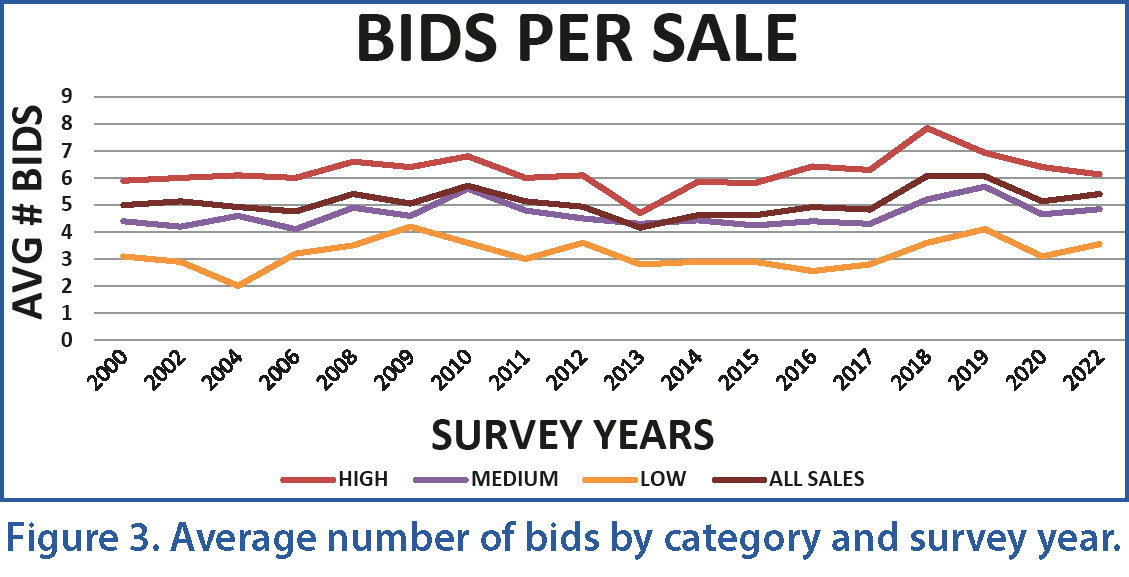

Sale bids: Across all of the sale categories there were a total of 1,457 bids received for the 270 timber sales. This is an average of 5.40 bids per sale. This is higher than the average since 2000 of 5.08 but well short of the 6.07 average in 2018. For high quality sales the average number of bidders was 6.13. This is short of the average number of 6.25 since 2000 and well short of the high of 7.85 in 2018. In fact, this year’s average was the least since 2015. For medium quality sales this year’s average was 4.84. This exceeded the average of 4.64 and is the highest number since the record of 5.67 in 2019. Finally, for the low quality sales the average number of bidders in 2021 was 3.55. This is considerably higher than the average of 3.17 since 2000 and the most since the 4.1 in 2019. See Figure 3.

Conclusions: According to the 2021 survey it shows that timber prices across all sale categories were very good or even record breaking. Indications are also that landowners are taking advantage of these prices and timber available for sale is at high levels. Interest from bidders remains strong though some smaller bidders may be getting priced out of the higher quality sales.

Consultant Comments and Other Thoughts

• Tariffs were generally considered to have a dampening effect on Indiana timber prices through 2020 as a high percentage of Indiana timber is exported, particularly to China. The easing of tariffs in 2021 has expanded markets and demands for Indiana timber, particularly higher value species and grades.

• High values for black walnut and white oak, in particular, have pushed up prices and somewhat distort timber values. Sales without much walnut or white oak tend to bring lower average prices.

• The white oak market continues to be driven by the stave market (whiskey barrels). Demand seems to exceed supply and stave prices push the veneer prices higher and pull the lumber values up. Large white oak especially brings higher values even if they are not high-quality trees.

• Black walnut demand for both veneer and lumber remain high.

• Rising tulip prices throughout much of 2021 made many medium quality sales bring higher than expected prices. This trend continues going into 2022.

• In southern Indiana large quantities of pine are being sold as there are several different markets available.

• Pallet (low grade) prices have risen throughout the year and continue to be strong.

• Red oak prices have improved in 2021 (exports?) but continue to lag behind the high prices of past years.

• Good stuff almost always sells well but it doesn’t mean you should sell it.

• Access and contract terms are important to timber value. There is so much timber available for sale that buyers can be somewhat selective and some buyers may choose to avoid sales with tough terms or logging problems.

• Many bidders continue to buy now to log next year or beyond. However, some of the smaller buyers are reluctant, at today’s prices, to put that much money out there for that long so they tend to buy as they go.

• Even modest amounts of walnut or white oak, especially if high quality, will carry a sale of lower valued trees.

• Sealed bid sales on marked and tallied timber offered to a wide range of buyers is the only way to make sure you get the best price for your timber on any given day.

• While significant volumes of live ash are only found in parts of southwestern Indiana, the price is strong when available.

• Landowners need to avoid using high timber prices as an excuse for poor forest management. Planning, waiting for trees to be ready, controlling invasive species and timber stand improvement is still important for the long-term health and productivity of forests and will pay off in the long term.

Professional Consulting Foresters responding to this survey in alphabetical order: Arbor Terra (Mike Warner and Jennifer Boyle Warner), Bear Forestry (Abraham Bear), Cox Forestry Consultants, LLC (David Cox), Creation Conservation, LLC (Brian Gandy), Crowe Forest Management (Tom Crowe and Jacob Hougham), Chris Egolf, Florine Enterprises, LLC (Jake Florine), Gregg Forest Services (Mike Gregg), Habitat Solutions (Dan McGuckin), Haney Forestry, LLC (Stuart Haney), Haubry Forestry Consulting, Inc, (Rob Haubry), Hoosier Forestry Consultants, LLC (David Vadas), Meisberger Forestry, LLC (Matt Meisberger), Multi-Resource Management, Inc. (Doug Brown and Anthony Mercer), Thomas Pohl, Quality Forest Management, Inc, (Justin Herbaugh), Rooted In Forestry, LLC (Mike Denham and Andrew Suseland), Steinkraus Forest Management (Jeff Steinkraus), Turner Forestry, Inc. (Stewart Turner) and Woodland Works (Nate Kachnavage).