Hardwood Economics & Industry Update

The major story late this spring and early summer was price surges for lumber which was focused mainly on softwoods but got a lot of national media attention. Hardwood lumber prices increased too and for a lot of the same reasons but not to the extent observed in spruce, pine, and fir markets. Demand for lumber has been driven by strong US residential home construction and remodeling activity and export markets rebounding from pandemic slowdown.

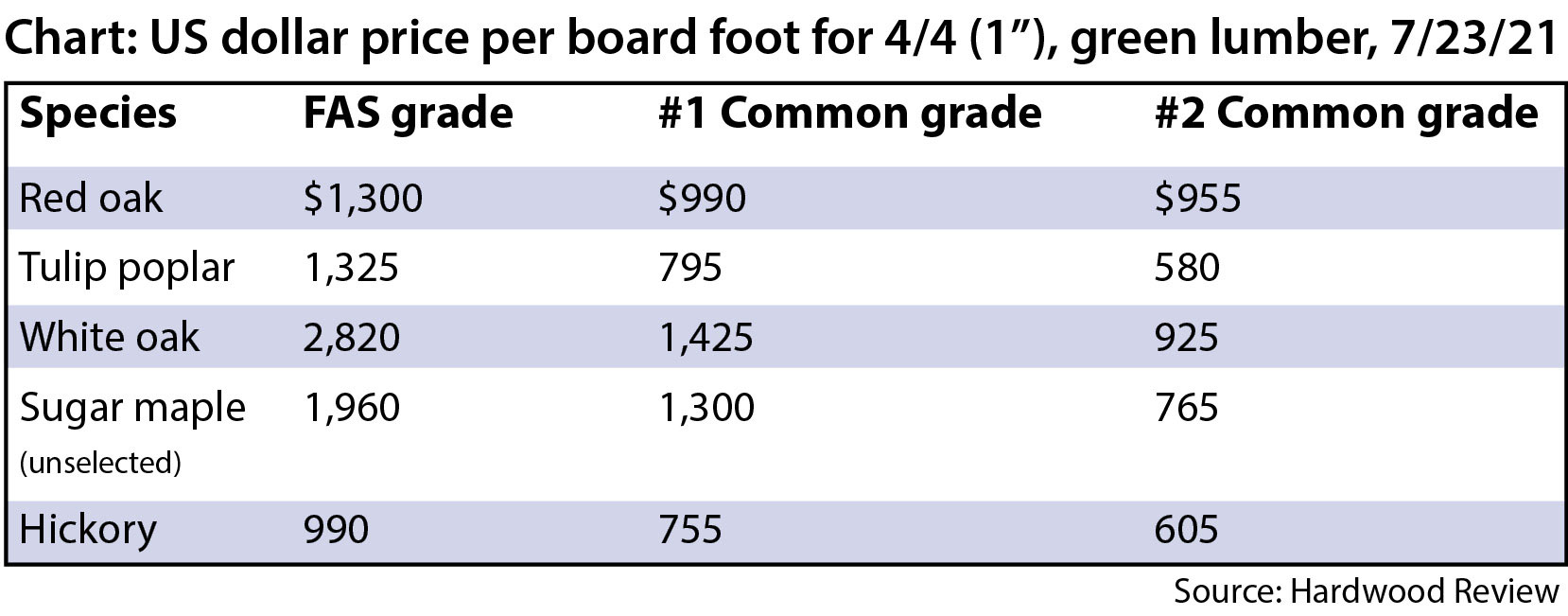

The State of Indiana has been tracking weekly, green lumber prices for hardwoods since 2002. The five most common hardwood species by volume of merchantable timber in Indiana’s forests are: red oak (14%), tulip poplar (13%), white oak (12%), sugar maple (11%) and hickory (10%). All at or very near historic price highs per board foot across grades.

Since the beginning of the year, #1COM lumber price per board foot has increased in all important Indiana hardwood species by the following amounts: red oak +36%, tulip poplar +59%, white oak +46%, sugar maple +31%, hickory +42%, soft maple +25%, ash +63%, walnut +60%, and cherry +58%. Supply constraints for lumber exist predominantly at the processing/sawmill capacity-level and not for standing timber stumpage. Thus, prices paid to forest landowners for stumpage have not been rising at the same levels as those listed above for green, sawn lumber.

According to the Hardwood Market Report, an industry publication, “Manufacturers are still pressing to increase lumber supplies needed to boost production. Most are bringing in more lumber than earlier in the year, but it has not been enough to attain the higher production goals. Sawmill output is still running behind pre-COVID levels, and there is significant competition for the lumber being produced.”

Mills and secondary manufactures, buoyed by higher prices, and encouraged mostly by strong domestic markets, are looking to expand production. There have been scattered business expansion announcements throughout Indiana recently in the millwork, cabinet, wood truss, and contract wood furniture manufacturing sectors. As before the pandemic, the major issue limiting hardwood industry growth is securing labor force. Transportation costs is another concern and lingering supply chain disruptions do exist, particularly for machinery. Indiana-based Wood Mizer, for example, reported recently that lead times had doubled for new orders of sawmills.

Efforts to assist businesses affected by the pandemic continue and there are a number of State and Federal funding programs in place to provide aid. One example is with the USDA Farm Services Agency which has recently begun accepting applications for its Pandemic Assistance for Timber Harvesters and Haulers Program that will provide relief to timber harvesters (loggers) and haulers that experienced a loss of at least 10 percent gross revenue in 2020, compared to 2019.

Exports of Indiana lumber and veneer have been consistently above 2020 levels so far this year. Indiana log exports were down in the first quarter but have recovered in April & May according to the most recent data available from the US Census Bureau. Indiana hardwood export markets mostly mirror those at the national level. China remains the dominant export market. Current year to date volumes shipped to China nationally are down by about 9% but dollar values of those shipments are up by 10%. Hardwood board foot shipment volumes are up to other major trading partners: Canada +59%, Vietnam +2% and Mexico +46%.

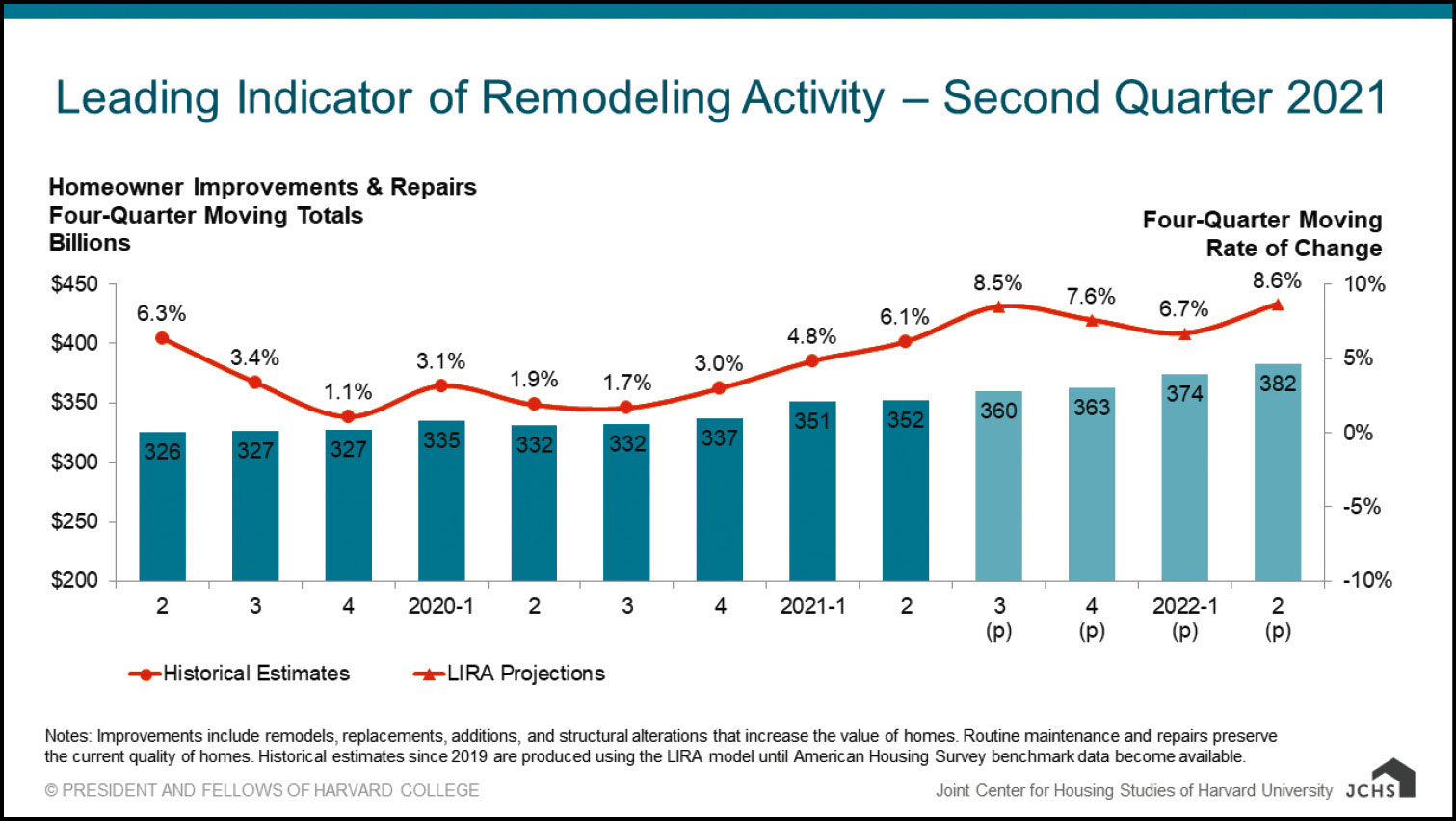

Since recovery from the 2008 financial crisis, over-reliance on the China export market has been an important concern of the US hardwood industry. The current, strong domestic market helps to address this issue. The Joint Center for Housing Studies of Harvard University reports that its Leading Indicator of Remodeling Activity projects annual growth in home renovation and repair will reach 8.6 percent by the second quarter of 2022. Things look good for the hardwood industry into the future.

Remodels, additions and home repair as well as new home construction are major drivers of hardwood demand. The promotional effort by the hardwood industry, Real American Hardwood branding effort and campaign, https://realamericanhardwood.com/ seeks to influence US consumers, encouraging them to select hardwoods as home investments are made. Hopefully you will see some of this consumer tested marketing material as you shop and an increasing amount of the industry will use the brand logos.

The national campaign to highlight the benefits of natural wood is enhanced by multiple efforts and opportunities occurring in Indiana. One is the Woods on Wheels project. This mobile, interactive exhibit is visiting communities throughout Indiana and providing education on forest management, hardwood industry and resource sustainability. You can call 765-516-3000 to request the traveling exhibit visit your community event or local school. Another opportunity that engages young people in learning about hardwoods will be at the Indiana State Fair where the “Forever Forest”, an interactive exhibit created by the Omaha Children’s Museum, will be open and free in the Farm Bureau Building with State Fair admission. Also, the Hoosier Hardwood Festival will take place August 27-29, 2021 at the Marion County Fairgrounds.

Woodland owners are a vital link in the hardwood industry and a key component of the Indiana Hardwood Strategy. Economic conditions are good and the hardwood industry is doing a lot to support the increased, wise utilization of our forest resource. These efforts aim to keep forests as forests and ensure a healthy future for us in all the ways we depend on our woodlands.

Chris Gonso is the Hardwoods Program Manager with the Indiana State Department of Agriculture.