2017 Indiana Consulting Foresters Stumpage Timber Price Report

This stumpage report is provided annually and should be used in association with the Indiana Forest Products Price Report and Trend Analysis. Stumpage prices were obtained via a survey to all known professional consulting foresters operating in Indiana. Reported prices are for sealed bid timber sales only (not negotiated sales) between a motivated timber seller and a licensed Indiana timber buyer. The data represents approximately 10 to 15 percent of the total volume of stumpage purchased during the periods from April 16, 2016 through April 15, 2017. This report has been published annually since 2001.

The results of the stumpage price survey are not meant as a guarantee that amounts offered for your timber will reflect the range in prices reported in this survey. The results simply provide an additional source of information to gauge market conditions.

Categories of timber reported: The prices reported are broken into three sale types—high quality, average quality, and low quality. A high quality sale has more than 50 percent of the volume in #2 or better red oak, white oak, sugar maple, black cherry, or black walnut. The low quality sale has more than 70 percent of the volume in #3 (pallet) grade or is cottonwood, beech, elm, sycamore, hackberry, pin oak, aspen, black gum, black locust, honey locust, catalpa, or sweet gum. The average sale is a sale that is not a low quality or high quality sale as defined above.

In the 2008 report some minor adjustments were made in the categories from the previous surveys. White ash was previously included as a component of the high quality sales and hickory was previously in the low quality group. No changes have been made in the categories so the 2017 data should compare well with the data collected since 2008.

Sale Activity Stays High

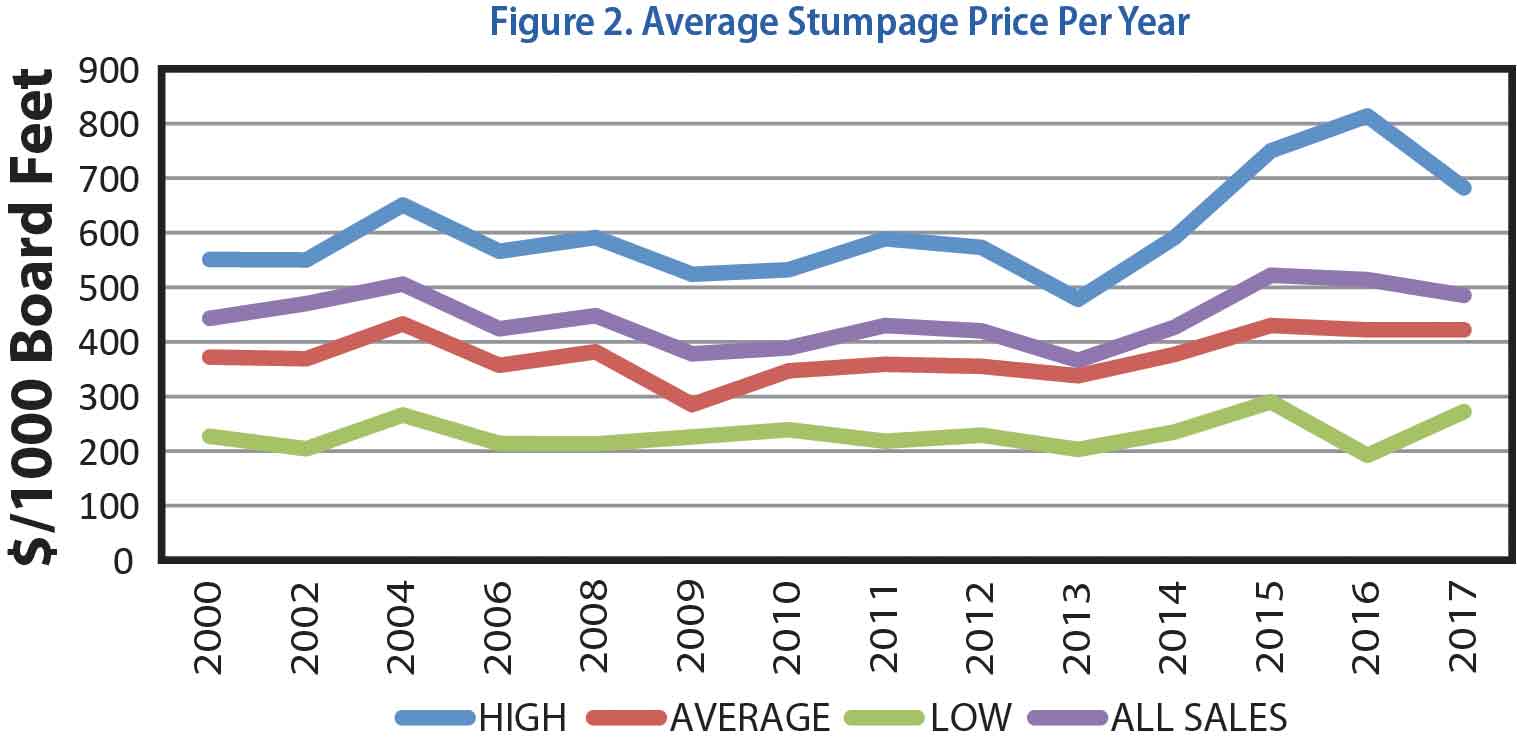

In 2016-17, there were 310 sales (plus 16 negotiated sales) which is down slightly from the 339 sales (plus 20 negotiated sales) during 2015-16 and down from the record 368 sales (plus 12 negotiated) in 2014-15 (Table 1).

The 15 of 18 consulting firms that reported in 2017 also reported in 2016 and 2015. The three firms that did not report this year only represented six sales last year with 325,318 board feet. Fourteen of the 18 firms have reported every year since 2011. The data from these 14 firms represents 95 percent of the total sales reported, therefore, the data should be very comparable among years.

The high number of sales for the last three years (Figure 1) is due to the relatively strong timber markets and an increase in landowners’ awareness of forest health concerns, particularly emerald ash borer.

Volume of Timber Sold

The total stumpage volume sold declined to 24,700,232 board feet (plus 983,276 board feet in negotiated sales) which is a drop from 29,044,240 board feet (plus an additional 1,257,863 board feet in negotiated sales) reported last year and a drop from the record high of 36,773,866 board feet (plus 683,235 board feet in negotiated sale) reported in 2015. Historically the average amount sold each year has been around 25 million board feet (with the exception of the recession years in 2009 and 2010). This volume may be an indication of the potential annual workload or capacity of the foresters who have consistently reported their data. The higher volumes reported in 2015 and 2016 may be due in part to sales delayed due to the recession.

The volume for the high quality sale totaled 8,089,611 board feet which is very similar to the 7,728,890 board feet sold last year. The highest total occurred in 2015 when 11,861,259 board feet was reported but only slightly lower than the 8.5 to 8.7 million board feet reported between 2011-14.

The medium quality sales totaled 14,928,599 board feet which is down from 19,782,273 board feet reported last year and down significantly from the 22,606,525 board feet reported in 2015. This volume, however, is similar to the average volume of timber sold since the adjustments were made to the survey in 2008. In 2008, ash was shifted from the high value category to medium value and hickory was shifted from low value to medium value. The impact of the ash has likely had more influence due to the increased amount of ash on the market due to mortality or pending mortality caused by emerald ash borer.

Lower quality sales increased slightly to 1,682,002 board feet from 1,533,077 board feet reported in 2016, but is still down from 2,486,082 board feet and 2,657,366 board feet in 2015 and 2014, respectively. The volume of lower quality sales has generally been around 3 million board feet. The majority of the nearly 1 million board feet sold in negotiated sales would be low quality / value sales, which is why most were negotiated. Part of the decline may also be the result of more ash being on the market which would shift the sales into the medium category.

Value of Timber Sold

Total timber value sold in the 2017 reporting period declined to $12,272,227 compared to $14,939,352 reported in 2016 from the record high of $19,207,898 reported in 2015. Although lower than the past two years, the 2017 value is still nearly as high as any other value reported since the survey began in 2001. The high quality sales brought $5,519,784, the medium quality sales $6,294,691, and the low quality sales $457,752.

High Quality Sales Get More Interest

In 2017, a total of 1,496 bids were received on the 310 sales for an average of 4.83 bids per sale down from 5.14 bids per sale last year but higher than the 4.62 bids per sale received in 2014 and 2015. The high quality sales received 6.3 bids, which was down slightly from 6.43 bids last year but higher than 5.82 bids in 2015 and 5.85 bids in 2014. The 4.3 bids per sale on medium quality sales is also down slightly from 4.4 bids last year and has been very consistent the last several years. The number of bidders on the low quality sales increased to 2.8 bids per sale up from 2.55 bids per sale last year but consistent with the number of 2.9 bids from 2.89 bids in 2015 and 2014.

The high number of bids on the higher quality sales reflects the strong market for the better quality timber. In theory more competition also results in a higher stumpage price.

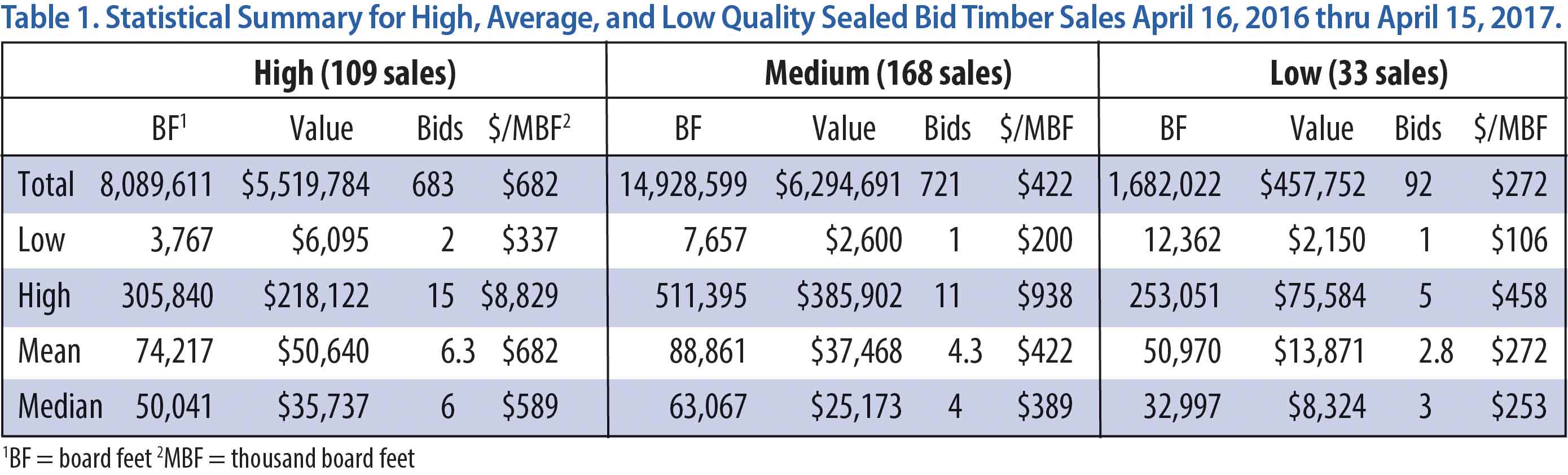

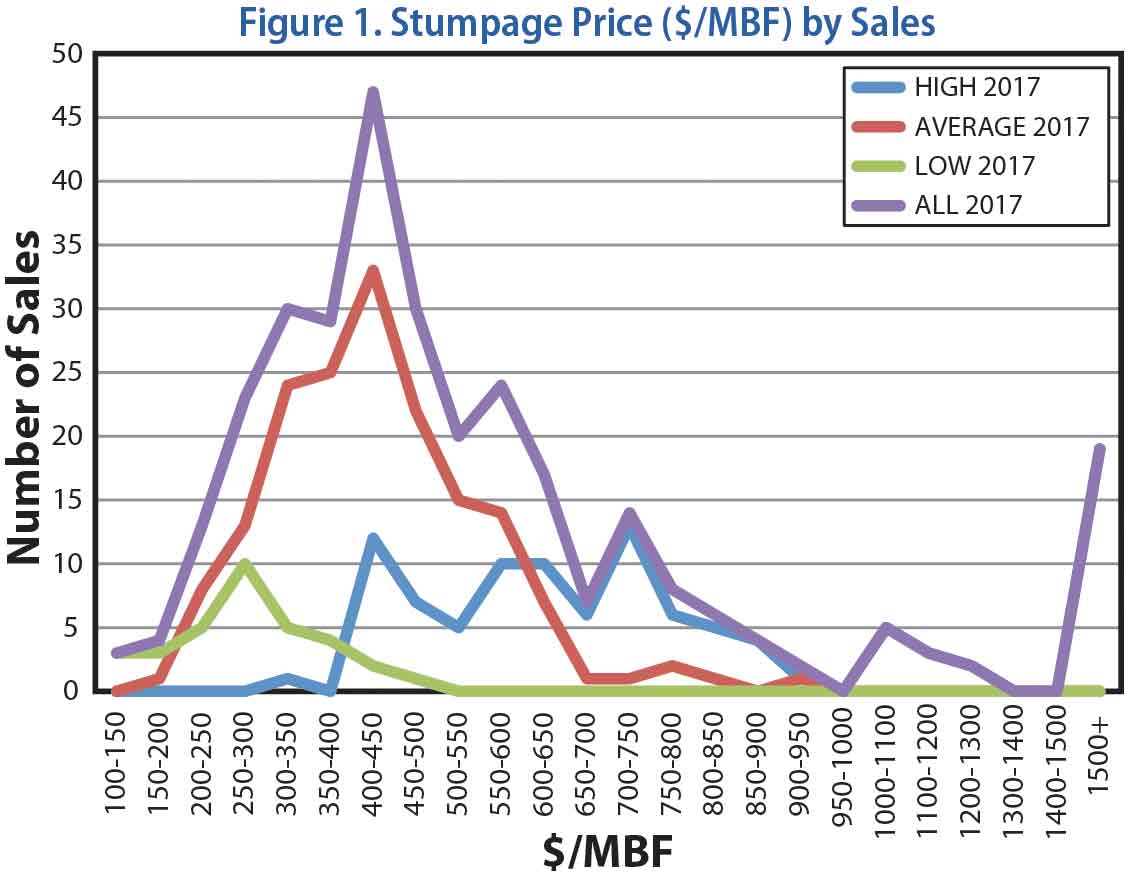

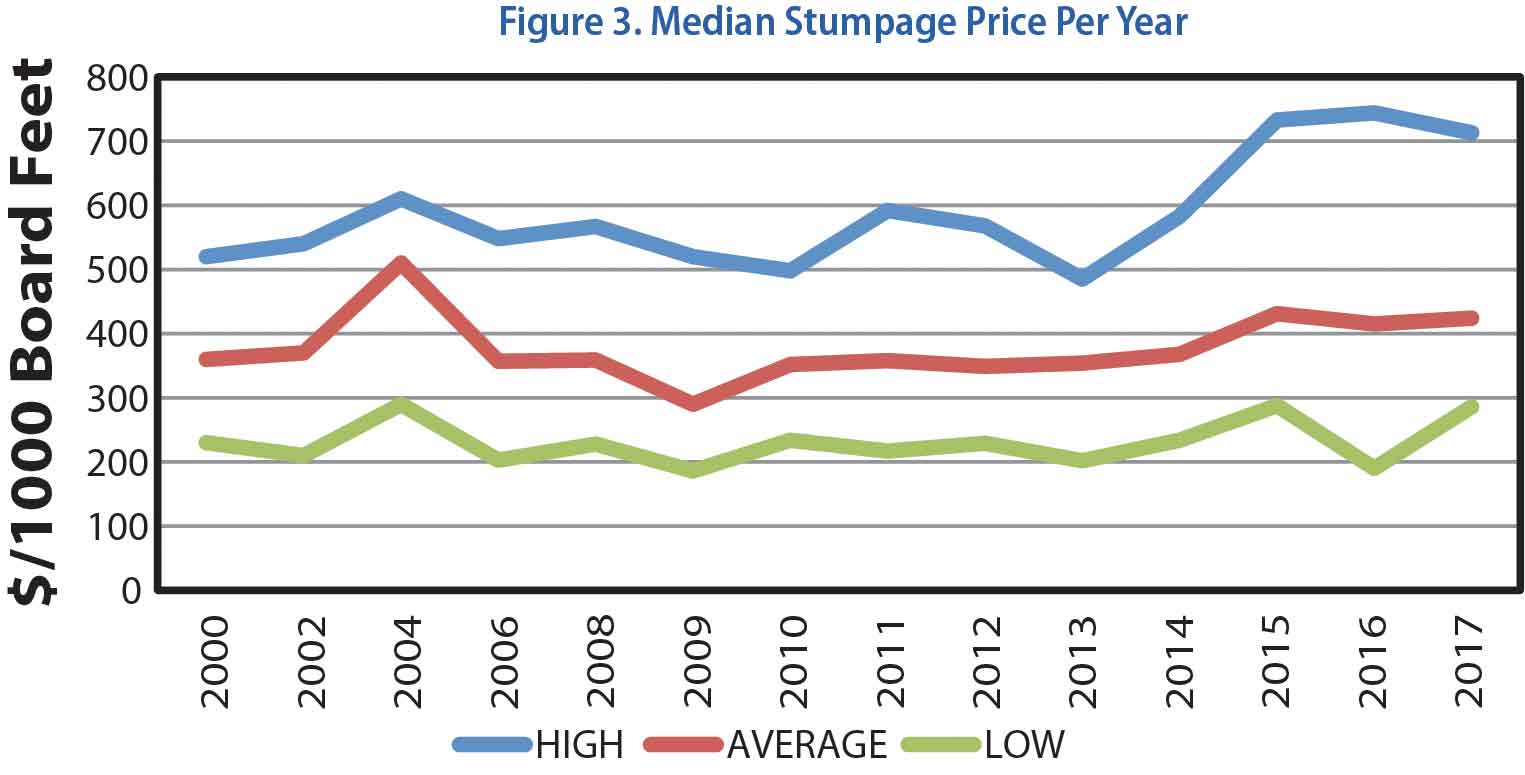

Stumpage Prices (See Table 1, Figures 2 & 3)

The average stumpage price for all the sales reported was $497/MBF, down slightly from $514/MBF in 2016, which is the third highest value reported and down only slightly from highest price of $522/MBF reported in 2015. The high quality sales appeared to have declined significantly with an average stumpage value of $682/MBF (median value of $713/MBF) down from the 2016 reported value of $814/MBF (median value of $744/MBF) which is an increase from the previous average high of $750/MBF in 2015 (median value of $733/MBF). Although there is a significant difference in the average value, the change in the median value is much less significant—2017 - $713/MBF; 2016 - $744/MBF; and 2015 - $ 733/MBF. Based on the distribution of the value of the sales, median is likely the best indicator. This year there were 19 sales that brought over $1.50 per board foot and 29 sales that brought over $1 per board foot. Most of these sales reported a very high component of black walnut.

The average stumpage price for the medium quality sales is $422/MBF (median value of $424) which is the same as the 2016 average stumpage value of $430/MBF (median value $415/MBF). The highest average stumpage price for medium quality sales was $433/MBF reported in 2004.

The average stumpage value for the low quality category increased significantly to $272/MBF (median value of $286/MBF) which is much higher than the value of $192/MBF (median value $190/MBF) reported in 2016. This value, however, is similar to the record value of $290/MBF reported in 2015. The range for the stumpage prices has generally been between $200-$230/MBF since 2001. The low number of low quality sales reported last year along with a few larger very low quality sales likely had a significant impact on last year’s value being so low.

This year 29 sales (9.4%) brought over $1.00 per board foot compared to 31 sales (9.2%) last year. The number of “very high value” sales has been consistent since 2015 (36 sales or 9.8%). However, the number is generally higher than prior to 2014. This increase is largely attributed to the high prices associated with black walnut and white oak. These very high value sales are generally outliers that may distort the average stumpage value for most woods, which is why the median value is likely the best indicator of value.

Landowners should keep in mind that markets are only one factor to consider when selling timber. The condition of the tree is one of the most important factors that determine when is the right time to sell a specific tree. Is the tree increasing in value or declining – is the trees condition (health and vigor) going to decline, stay the same, or improve? Trees should be sold based on their problems or lack of potential than their current value. Ideally, you should sell your good trees when they have reached their peak. Another factor to consider is what impact that tree will have on the health, vigor, and resiliency of the future stand. Is it competing with a better future crop tree or will it benefit or negatively impact natural regeneration? The lower quality sales are generally improvement harvests (i.e., commercial weeding) and the opportunity cost in lost productivity of the forest by not conducting these sales can be significant. If done properly the value per board foot should increase in subsequent sales along with the financial productivity and quality of the woods.

The stumpage prices for all sales, high quality sales, medium quality sales, and low quality sales held between April 16, 2016 and April 15, 2017 has a typical distribution (Figure 1). The data is distributed along a bell curve for low quality, medium quality, and all sales. The bell curve indicates the range in values that most sales fall. The jagged line at the higher end of the high quality sales is evidence of the variation in value special trees, and especially, the effects that high value walnut can have on the price.

All sales—low, medium, and high quality—can be affected by sales with potential veneer or by the presence of a few high value trees, particularly black walnut and white oak. It is important for landowners reading this report to realize their timber typically will fall within the range of stumpage prices but probably will not fall into the outlying values. This makes it important to work with a professional who works for you when selling timber so that you know exactly what you have. An educated seller and an educated professional buyer working together generally results in a very successful sale.

The weighted average stumpage price by sale type (obtained from this survey in 2000, 2002, 2004, 2006, 2008, 2009, 2010, 2011, 2012, 2013, 2014, 2015, 2016, and 2017) is reported in Figure 2. The weighted average of the stumpage price is the total dollar value for each sales category. The median stumpage price per year for each sales category is reported in Figure 3. The median price is the amount where half of the sales are higher and half are lower. The price reported is per 1000 board feet ($/MBF) for standing timber.

Comments

Standing timber prices often vary during the year and can change rapidly based on supply and demand. The prices are influenced by many factors including tree species, the tree quality and size, where you are in the state, the distance to a sawmill, the access and accessibility of the trees, the size of the harvest, the terms of the sale, etc. This report and the comments below are merely a snapshot in time. It is therefore important to work with a forester to get an up to the minute view of the existing markets.

• Black walnut continues to be hot. Demand for walnut and white oak remains strong.

• White oak markets continue to be very good due to the export markets (especially to China) and high demand for barrel staves. Routinely get inquiries from around the world for high quality walnut and white oak.

• Red oak prices are showing some improvement, especially for larger, higher quality trees.

• Cherry markets are finally beginning to come out of a long slump.

• Poplar demand remains good and steady, especially for larger trees.

• Sugar maple demand is getting stronger, especially for white wood.

• Ash trees or logs, if “alive (free of emerald ash borers) and larger” are bringing a good price. Most of the better logs are exported. Buyers remain leery of questionable ash. The ash market is strong but finding trees that cut white is a concern when buying standing trees.

• Hickory is still a niche market; interest seemed to moderate over the year and has resulted in lower prices.

• High quality timber is generally in high demand. A few good trees can attract buyers to sales that are generally low quality.

• Low grade timber dropped at the beginning of 2017 but is doing better now. Demand for ties, cants, and flooring grade lumber has been weaker in 2017.

• Larger sales draw more interest. Smaller sales will draw interest if enough quality present or access is good.

• Sales with low volumes are hard to sell unless some high quality timber is present or access is desirable.

• The dwindling number of professional loggers continues to be a problem. Buyers continue to voice concerns about having enough logging crews or finding good help.

• Beginning to see companies update equipment in the last couple years in order to increase output.

General Management Comments

Several of these comments have been made in years past but they are still very true today.

1.) Manage your woodland - have a plan, know what you have, and what you need to do, timber is valuable, and taxes are low; 2) grow quality; 3) if you want the best price and want to leave timber for the future, then hire a consulting forester; and 4) don’t plow or blacktop the access road and expect to get your timber out of the log yard to the county road.

Plan early and thoroughly if considering a harvest to allow for control of invasive species, timing the markets, and better access. Contact the forester early to allow him to schedule the work and provide guidance.

Access and terms are very important when selling timber. Timber sales that had year round harvest access were in high demand and were of higher value to buyers. Limitations to access such as “no harvesting during deer hunting season” or “no access when crops are in the field” will reduce bidders and result in lower bids. Give access strong consideration. In most cases the higher income from the timber will be more than the income lost from the acre or so of crops

• To receive a premium price for your timber provide timber purchaser plenty of time (possibly 2-2½ years) to remove timber (especially with wet sites after a couple very wet years). A good map drawing showing wood location(s) of marked timber, access, fences, fields, roads, creeks, and possible yarding site(s) make the process go better with fewer complications.

• Tenant farmers must be engaged and they must be cooperative for the harvest to run smoothly. Too often they work the field after the crops are harvested making access difficult or impossible.

• Bad weather this past winter (wet with no hard freezes) kept buyers behind on harvests. I believe this attributed to weaker pressure on bidding.

• Persistent wet conditions for most of the last year have made for difficult logging conditions making it even more important to have everyone (landowner, forester, loggers, farmers) involved and willing to be flexible with the process. A return visit by the logging crew may be necessary when conditions improve to smooth trails and landings. It may be advantageous to improve or prepare old skid trails during the summer prior to logging when condition are good.

Invasive plants (bush honeysuckle, ailanthus) continue to spread. Too many stands are being cut without pre-harvest control (poor planning) and the stand is overrun within a year or two of the harvest, negatively impacting the long term health and productivity of the woods. Control invasive species prior to any harvesting. Cost share assistance may be available to control the invasive plants from your local Natural Resource Conservation Service office.

Invasive species control is much more difficult after a timber harvest and the disturbance of the logging quickly magnifies the problem. Control them first even if it means delaying the harvest for a couple years.

Consulting Foresters that have contributed to this report in alphabetically order include: Arbor Terra Consulting (Mike Warner), Crowe Forest Management LLC (Tom Crowe and Jacob Hougham), Christopher Egolf, Gandy Timber Management (Brian Gandy), Gregg Forestry Services (Mike Gregg), Habitat Solutions LLC (Dan McGuckin), Haney Forestry, LLC (Stu Haney), Multi-Resource Management, Inc. (Thom Kinney and Doug Brown), Meisberger Woodland Management (Dan Meisberger), Chris Neggars, Quality Forest Management, Inc (Justin Herbaugh), Ratts Forestry (Chuck Ratts), Abe Bear, Stambaugh Forestry (John Stambaugh), Turner Forestry, Inc. (Stewart Turner), and Wakeland Forestry Consultants, Inc. (Bruce Wakeland, Mike Denman, Andrew Suseland).